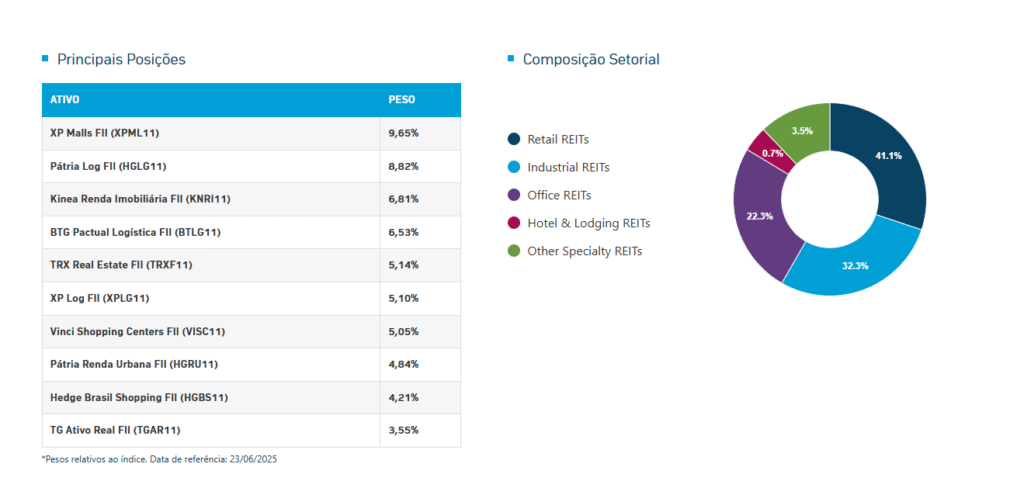

HERT11 is an ETF launched by Hedge Investments in June 2025 that aims to track the FTSE Hedge Brazil All Equity REITs index. Unlike the broader IFIX index, HERT11 focuses exclusively on physical real estate exposure and is largely concentrated in Shopping & Retail (~41%), Industrial & Logistics (~32%), and Offices (~22%).

Designed with global investors in mind, HERT11 is Hedge’s flagship effort to elevate the Brazilian REIT market to international standards. The fund includes 30 high-liquidity FIIs, making it the most investable proxy for foreign capital seeking access to the country’s commercial real estate sector.

Unlike the IFIX index, which includes ~40% exposure to credit receivables, HERT11 is exposed solely to brick-and-mortar funds.

Hedge charges a management fee of 0.50% of AUM, and dividends are automatically reinvested.

The visuals below, sourced from Hedge Investments, provide a snapshot of the fund’s top holdings and sector allocation as of June 23, 2025.

Each fund in the table below is categorized by sector (e.g., Shopping, Logistics, Offices), and the table is sortable by index weighting, sector, and manager. Where available, I’ve included links to detailed overviews. Click the ‘Read’ column to explore.

This list was last updated on July 4, 2025. It is based on Hedge’s published index composition and is maintained manually for educational purposes only. Sector weights may not align precisely with the pie chart above, as some funds span multiple categories.

For international investors looking for a quick, diversified entry into Brazilian REITs, the HERT11 ETF offers a practical starting point.

However, like many index products, it includes funds with mixed quality and limited liquidity, including exposure to office REITs that some investors may prefer to avoid. As a result, more active investors often prefer to build their own portfolio of high-conviction funds across sectors like shopping malls or logistics. The expense ratio is also relatively high.

For more on how I choose high-quality Brazilian REITs (FIIs), check out my FII guide, or explore the FII managers behind the funds on this list.

| Ticker | Fund | Manager | Sector | Weighting | Overview |

|---|---|---|---|---|---|

| XPML11 | FII XP MALLS | XP Asset Management | Shopping | 9.69% | Read |

| HGLG11 | FII HGLG PAX | Patria Investimentos | Logistics | 8.50% | Read |

| KNRI11 | FII KINEA | Kinea | Hybrid | 6.65% | Read |

| BTLG11 | FII BTLG | BTG Pactual | Logistics | 6.36% | Read |

| XPLG11 | FII XP LOG | XP Asset Management | Logistics | 5.08% | Read |

| TRXF11 | FII TRX REAL | TRX Real Estate | Urban Real Estate | 4.96% | Read |

| VISC11 | FII VINCI SC | Vinci Partners | Shopping | 4.81% | Read |

| HGRU11 | FII HGRU PAX | Patria Investimentos | Urban Real Estate | 4.75% | Read |

| HGBS11 | FII HEDGEBS | Hedge Investments | Shopping | 4.09% | Read |

| TGAR11 | FII TG ATIVO | TG Core Asset | Other | 3.53% | |

| PVBI11 | FII PVBI VBI | Patria Investimentos | Offices | 3.38% | Read |

| HSML11 | FII HSI MALL | HSI Investimentos | Shopping | 2.87% | Read |

| BRCO11 | FII BRESCO | Bresco | Logistics | 2.81% | |

| LVBI11 | FII LVBI VBI | Patria Investimentos | Logistics | 2.65% | |

| TVRI11 | FII BB PRGII | Tivio Capital | Banks | 2.46% | |

| MALL11 | FII MALLS BP | Genial | Shopping | 2.32% | |

| HGRE11 | FII HGRE PAX | Patria Investimentos | Offices | 2.25% | |

| GARE11 | FII GUARDIAN | Guardian Asset | Urban Real Estate | 2.16% | |

| JSRE11 | FII JS REAL | JS Real Estate | Offices | 2.16% | |

| RBVA11 | FII RIOB VA | Rio Bravo | Urban Real Estate | 2.13% | |

| ALZR11 | FII ALIANZA | Alianza Trust | Hybrid | 2.04% | |

| VILG11 | FII VINCI LG | Vinci Partners | Logistics | 2.03% | |

| GGRC11 | FII GGRCOVEP | Zagros Capital | Logistics | 2.00% | |

| BRCR11 | FII BC FUND | BTG Pactual | Offices | 1.84% | |

| KORE11 | FII KORE | Kinea | Offices | 1.25% | |

| CPSH11 | FII CPSH | Capitania Shoppings | Shopping | 1.25% | |

| BBIG11 | FII BBIG | BB Asset | Shopping | 1.14% | |

| RBRP11 | FII RBR PROP | RBR Asset | Hybrid | 1.02% | |

| SARE11 | FII SANT REN | Santander Renda de Alugueis | Hybrid | 0.69% | |

| HTMX11 | FII HOTEL MX | BTG Pactual | Other | 0.67% | |

| ITAÚ SOBERANO RF LP FICFI | N/A | Itau Unibanco S.A. | Fixed Income | 1.74% |