Launched in 2011, MXRF11 is one of Brazil’s oldest and largest real estate investment funds (FIIs) by market capitalization. It is the third-largest CRI-focused FII, ranking behind KNCR11 and KNIP11. Managed by XP Asset Management, the fund has a market cap of approximately R$4.1 billion and represents 2.97% of the IFIX index. The portfolio manager is supported by a team of 11 analysts and 4 engineers shared across multiple XP funds.

MXRF11 aims to generate long-term returns by investing primarily in CRIs, allocating 80% of NAV to credit instruments and up to 20% to high-yield real estate-linked financial swaps (permutas financeiras) and selected FII positions. The fund is benchmarked against floating short-term interest rates (CDI), although around 85% of its CRIs are indexed to inflation (IPCA). The portfolio has a duration of 4.2 years.

Compared to KNCR11 and KNIP11, MXRF11 uses a more diverse, actively managed, and hybrid strategy, with greater exposure to development-linked structures and secondary market trades.

Last Updated: July 3, 2025

MXRF11 Key Facts

| Metric | Value |

| Fund Name | Maxi Renda FII |

| Manager | XP Asset Management |

| Administration Fee | 0.90% |

| Manager Website | https://www.xpasset.com.br/fundos/maxi-renda/ |

| Inception | 20/09/2011 |

| Sector | CRI |

| Market Cap | R$4.1B |

| Number of Financial Instruments | 82 CRIs, 10+ FIIs, 9 Swaps |

| Current Price | R$9.47 |

| Price-to-Book Value | 1.00x (trades at NAV) |

| Dividend Yield (Trailing 12M) | 10.98% |

| Index/ETF Inclusion | IFIX |

Since inception, the fund has traded between R$7.00 and R$13.66. It currently trades at book value.

Performance Track Record

Source: Google

Credit Portfolio

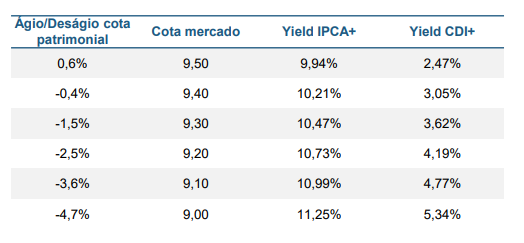

The table below shows management’s estimate of MXRF11’s credit portfolio returns at different market prices. Based on the current trading level, the implied gross yield (before fees) is approximately IPCA + 10% or CDI + 2.5%.

Source: XP May Management Report

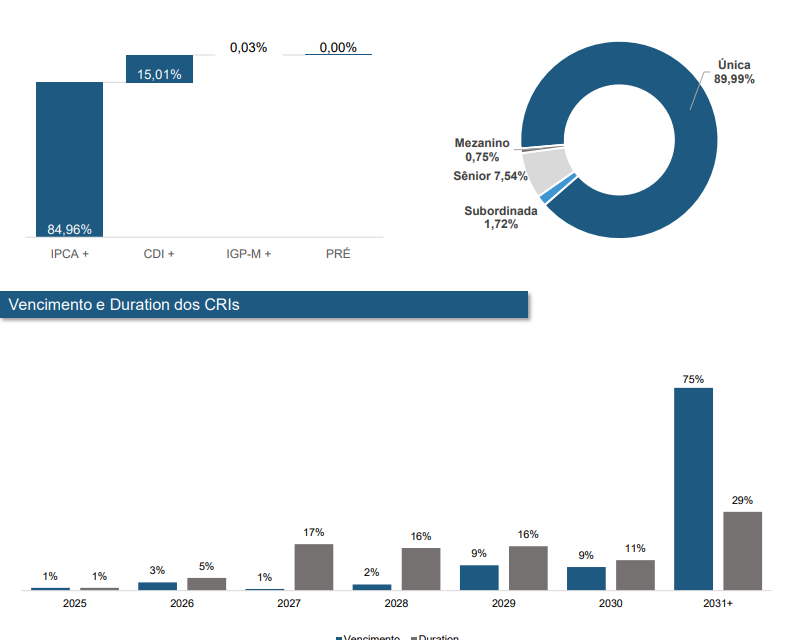

The fund’s largest exposures are to CRIs backed by Residential projects (32.2%), followed by Other (24.3%) and Essential Retail (19.5%). Approximately 85% of the portfolio is indexed to inflation (IPCA) and 15% to short-term interest rates (CDI). Most of the CRIs (90%) are issued as single-tranche structures, with only 2.5% subordinated to other creditors.

The portfolio has a long maturity profile, with 75% of CRIs maturing after 2030.

Source: XP May 2025 Management Report

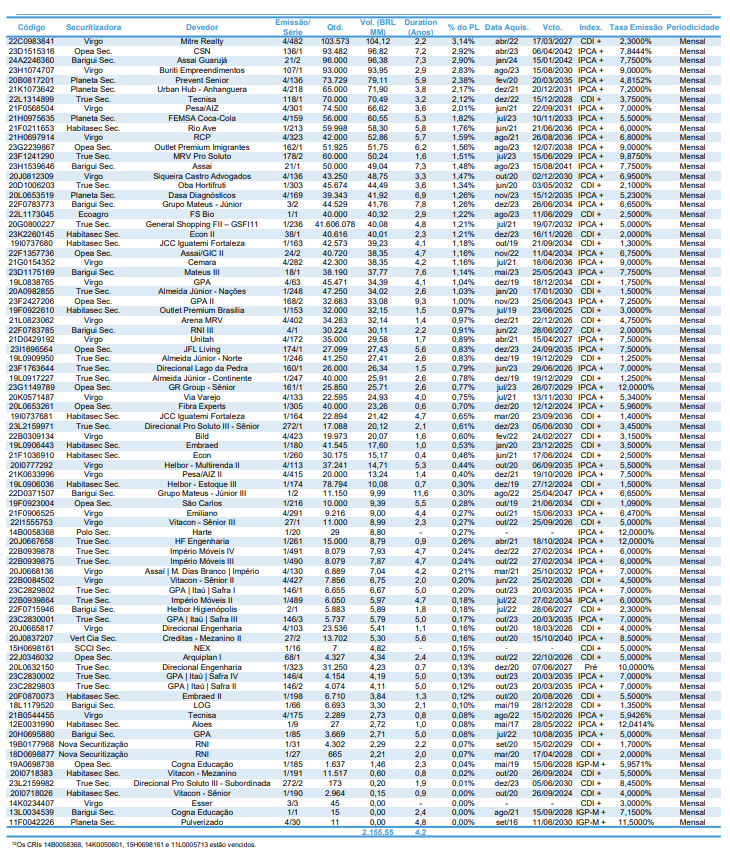

The fund currently holds a diversified portfolio of 82 CRIs, with the largest individual exposure being to Mitre Realty, representing 3.14% of net assets.

The table below lists MXRF11’s CRI holdings by portfolio weight, illustrating both diversification and transparency across issuers, sectors, and structures.

Source: XP Website

The fund also maintains a significant allocation to other FIIs and financial swaps.

Sector Comparison & KPIs

📈 Market Cap & Yield

MXRF11 is the third-largest CRI FII on the IFIX, with a market capitalization of R$4.1 billion. It has a 12-month dividend yield of 10.96%, and an annualized yield of 12.7% based on May’s distribution.

🧮 Valuation

MXRF11 trades at a price-to-book ratio of 1.00x. Its portfolio duration is 4.2 years, which means the fund’s market value would be expected to rise or fall by approximately 4.2% for each 1 percentage point change in long-term interest rate expectations, assuming other factors remain constant.

💸 Dividend Pattern

MXRF11 has historically delivered a high and consistent dividend yield. Monthly variations are influenced primarily by the official IPCA inflation index, particularly the rate measured two months prior to each distribution.

Historical annual accumulated IPCA rates are available here, and can be compared to the fund’s monthly distributions.

During periods of market stress (such as during COVID), the fund maintained relatively high real yields and performed well on a risk-adjusted basis.

👉 Scroll sideways on mobile to view the full chart

📘 Learn More

- If you’re new to Brazilian REITs (FIIs), check out my Guide for Global Investors or How I Choose FIIs

- For some great charts and graphs check out MXRF11’s page on Funds Explorer

🔗 Related Pages

Disclosure

As of this writing, I do not hold a position in MXRF11, though that may change in the future. This content is for informational purposes only and does not constitute financial advice. Always do your own research and consult a licensed advisor before making investment decisions.

IMPORTANT LEGAL DISCLAIMER

The information provided on this website is for general informational purposes only. All content is based on personal opinions, experience, or publicly available data, and is not intended as financial, legal, tax, or investment advice. Nothing here should be construed as a recommendation to buy, sell, or hold any financial instruments.

I am not a certified financial advisor, and I do not know your personal financial situation. Always consult with a qualified professional before making any investment decisions. Gringo Investor and its creator disclaim all liability for any loss or damage incurred as a result of reliance on this information.

Investing involves risks, including the potential loss of principal. Past performance is not indicative of future results.

This site is operated for an international audience and is not intended to comply with CVM regulations or provide formal investment recommendations in Brazil.