Launched in 2012, KNCR11 is Brazil’s largest real estate investment fund (FII) by market capitalization, and the largest CRI-focused FII, ranking ahead of peers such as KNIP11 and MXRF11. Managed by Kinea Investimentos, the fund has a market cap of approximately R$8.0 billion and accounts for 5.71% of the IFIX index. The portfolio manager is supported by a team of 11 credit analysts who are shared across multiple Kinea funds.

The fund targets a return in line with Brazil’s overnight interbank deposit rate (CDI), which stood at 15% at the time of writing. It does so by investing in low-risk credit instruments indexed to CDI, with monthly distributions that adjust to changes in short-term rates.

In effect, KNCR11 serves as a counterbalance to brick-and-mortar FIIs. When real interest rates rise, its floating-rate income increases, even as property-backed FII values may decline. Conversely, when rates fall, KNCR11’s yield decreases, while traditional FIIs may benefit from valuation gains.

Last Updated: June 30, 2025

KNCR11 Key Facts

| Metric | Value |

| Fund Name | Kinea Rendimentos Imobiliarios |

| Manager | Kinea Investimentos |

| Administration Fee | 1.08% |

| Manager Website | https://www.kinea.com.br/fundos/fundo-imobiliario-kinea-rendimentos-kncr11/ |

| Inception | 15/10/2012 |

| Sector | CRI |

| Market Cap | R$8.0B |

| Number of Credit Instruments | 76 CRIs |

| Current Price | R$105.89 |

| Price-to-Book Value | 1.02 |

| Dividend Yield (Trailing 12M) | 11.86% |

| Auditor (Last Annual Report) | PwC |

| Index/ETF Inclusion | IFIX |

As a vehicle tied to Brazil’s floating-rate CDI, the fund has maintained relatively stable market value since inception, with some notable declines during periods of macroeconomic stress, such as COVID.

More recently, the fund experienced temporary stress in December 2024, when interest rate expectations rose and both the Brazilian real and the IBOVESPA declined significantly. However, it quickly returned to normal trading patterns and now trades near its net asset value, at approximately 1.02x book value.

This suggests that the fund has generally been managed prudently, though it is not immune to sharp market sell-offs or broader macroeconomic credit concerns.

Performance Track Record

Source: Google

Credit Portfolio

KNCR11 invests in higher-quality CRIs. As of June 27, management estimates that at a unit price of R$106, the portfolio offers a gross credit spread of CDI + ~1.25%, resulting in a net spread of approximately 0.17% after fees.

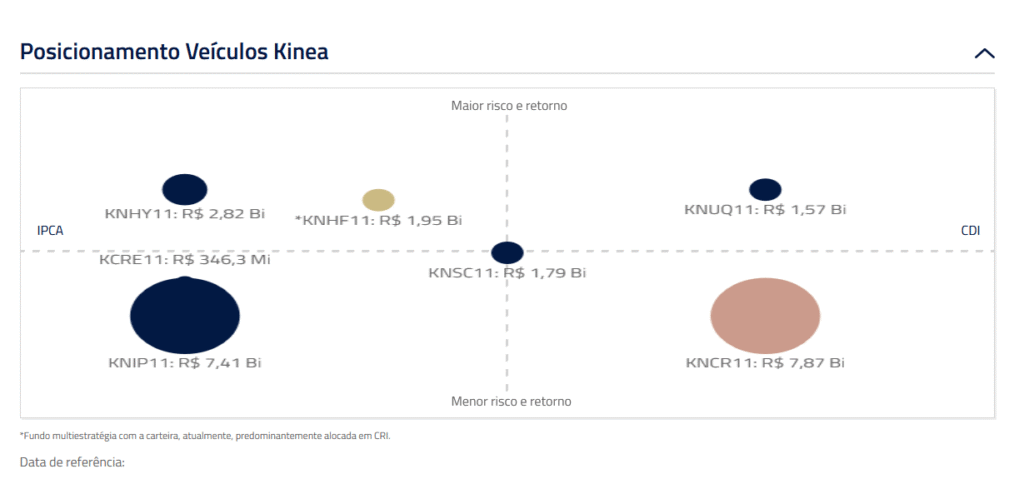

The chart below shows KNCR11’s positioning among Kinea-managed funds: large, lower-risk, and aligned to CDI rather than inflation-indexed (IPCA) instruments.

Source: Kinea Website

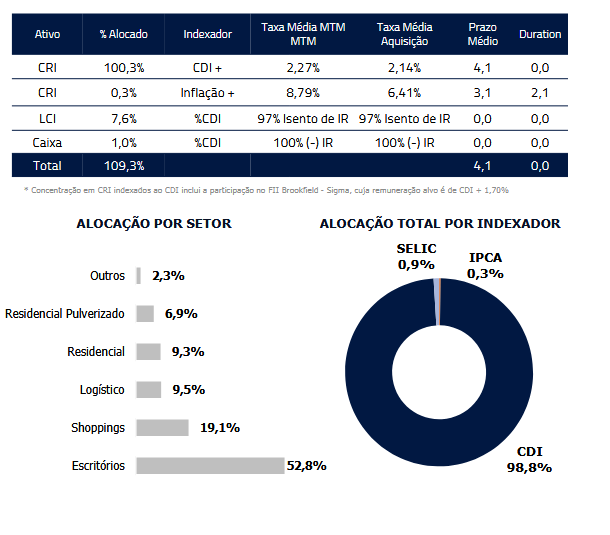

As of the end of May, KNCR11 had allocated 109.3% of its net assets across target instruments: 100.3% in CDI-linked CRIs, 7.6% in LCIs, and 1.0% in cash. The portfolio’s average duration is 4.1 years, and no credit events were reported.

The slight over-allocation likely reflects accrued interest and mark-to-market adjustments common in CRI funds, rather than leverage or excess risk.

The fund’s largest exposures are to CRIs tied to Offices (52.8%), followed by Shopping Malls (19.1%) and Logistics (9.5%). Many corporate CRIs are secured by collateral or the debtor’s balance sheet, which may help mitigate risk, especially in segments like Offices. However, not all CRIs are collateralized; that said, Kinea notes that exposures are limited to investment-grade issuers.

Source: Kinea May 2025 Management Report

The fund currently holds a diversified portfolio of 76 CRIs, with the largest individual exposure being to JHSF Malls, which accounts for 4.2% of net assets. A few CRIs are also associated with other FIIs, particularly within the shopping mall sector.

The table below lists KNCR11’s 30 largest CRIs by portfolio weight, illustrating both diversification and transparency. The remaining 46 instruments are also disclosed in full by Kinea but are excluded here for brevity.

Source: Kinea May 2025 Management Report

Potential risks in the portfolio include:

- A high concentration in office buildings (over 50% of the portfolio)

- Bullet maturities tied to purchase agreements that may not be honored

- CRIs backed by rental income, which are generally safer but still carry risks related to tenant quality and lease terms

- Lack of third-party credit ratings, making risk harder to assess compared to rated debentures (e.g. those issued by utility companies and rated by S&P or Moody’s)

- Exposure to macroeconomic shocks, which have occasionally caused the fund to trade at a discount to NAV

The highest loan-to-value (LTV) ratio among the office CRIs is 75%, though most are significantly lower. While the underlying assets appear to be of high quality, there is considerable variance between ‘AAA’ and ‘A’-rated properties. Some markets, such as Rio de Janeiro, continue to struggle with low occupancy. It’s also worth noting that many office FIIs, including high-quality names like PVBI11, currently trade at book values below 0.75x.

Overall, Kinea is a reputable manager, and the fund has performed well historically. It offers a high level of transparency, disclosing detailed information on all CRIs held.

Sector Comparison & KPIs

📈 Market Cap & Yield

KNCR11 is the largest FII on the IFIX, with a market capitalization of R$8.0B. It offers a 12-month dividend yield of 10.76%, and 13.6% based on May’s distribution. The current yield reflects a return above CDI for Brazilian resident investors, when accounting for the fund’s tax-exempt status (i.e. 15% income tax savings).

🧮 Valuation

KNCR11 trades at a price-to-book ratio of 1.02x, reflecting its floating-rate CRI holdings. Absent market stress, CRI defaults, or short-term shocks, the fund generally should not trade materially above or below book value. It fell by ~15% during the depths of COVID and by less than 10% during Brazil’s market turbulence in late 2024, and has since recovered.

💸 Dividend Pattern

KNCR11 has historically delivered consistent monthly dividends that fluctuate with CDI. The Selic rate reached 15.0% in June 2025, the highest since 2006, and likely the peak of the current cycle, pushing the May distribution to new highs. Going forward, we can likely expect distributions to plateau, followed by a gradual decline as the Central Bank (COPOM) begins easing policy, though macroeconomic surprises may impact this outlook.

Historical Selic rates are available here, and can be compared to the fund’s monthly distributions.

During periods of global stress (i.e. COVID), the fund did reasonably well at protecting principal, but didn’t outperform malls or office FIIs in terms of payouts, as Selic fell to just 2% and distributions followed suit. More recently, the fund has generated very strong income due to Brazil-specific stress that forced COPOM to hike rates aggressively.

As noted earlier, KNCR11’s structure may offer attractive diversification for investors also exposed to longer-duration credit instruments or brick-and-mortar FIIs, although those alternatives may present higher upside if long-term real interest rates decline.

👉 Scroll sideways on mobile to view the full chart

📘 Learn More

- If you’re new to Brazilian REITs (FIIs), check out my Guide for Global Investors or How I Choose FIIs

- For some great charts and graphs check out KNCR11’s page on Funds Explorer

🔗 Related Pages

Disclosure

As of this writing, I do not hold a position in KNCR11, though that may change in the future. This content is for informational purposes only and does not constitute financial advice. Always do your own research and consult a licensed advisor before making investment decisions.

IMPORTANT LEGAL DISCLAIMER

The information provided on this website is for general informational purposes only. All content is based on personal opinions, experience, or publicly available data, and is not intended as financial, legal, tax, or investment advice. Nothing here should be construed as a recommendation to buy, sell, or hold any financial instruments.

I am not a certified financial advisor, and I do not know your personal financial situation. Always consult with a qualified professional before making any investment decisions. Gringo Investor and its creator disclaim all liability for any loss or damage incurred as a result of reliance on this information.

Investing involves risks, including the potential loss of principal. Past performance is not indicative of future results.

This site is operated for an international audience and is not intended to comply with CVM regulations or provide formal investment recommendations in Brazil.