Launched in 2016, KNIP11 is Brazil’s second-largest real estate investment fund (FII) by market capitalization, and the second-largest CRI-focused FII, ranking behind KNCR11 and ahead of MXRF11. Managed by Kinea Investimentos (which also manages KNCR11), the fund has a market cap of approximately R$7.1 billion and represents 5.22% of the IFIX index. The portfolio manager is supported by a team of 11 credit analysts shared across multiple Kinea funds.

KNIP11 aims to generate long-term returns by investing in inflation-indexed real estate credit instruments, primarily CRIs (Certificados de Recebíveis Imobiliários), while maintaining a low credit risk profile. The fund is benchmarked against the IMA-B index, which reflects the performance of Brazilian government bonds indexed to the IPCA inflation rate. Its objective is to outperform the IMA-B by an annual spread of 0.50%, offering investors a way to preserve purchasing power and earn real returns through a diversified portfolio of inflation-linked receivables.

Unlike KNCR11, which is tied to a floating-rate return based on the overnight CDI rate, KNIP11’s receivable yields are impacted by monthly measured inflation but not directly by interest rates. As a result, KNIP11 can benefit more from declining real rates, though the opposite also holds true.

Last Updated: July 2, 2025

KNIP11 Key Facts

| Metric | Value |

| Fund Name | Kinea Indices de Precos |

| Manager | Kinea Investimentos |

| Administration Fee | 1.00% |

| Manager Website | https://www.kinea.com.br/fundos/fundo-imobiliario-kinea-indices-de-precos-knip11/ |

| Inception | September 16, 2016 |

| Sector | CRI |

| Market Cap | R$7.1B |

| Number of Credit Instruments | 112 CRIs |

| Current Price | R$89.11 |

| Price-to-Book Value | 0.97x |

| Dividend Yield (Trailing 12M) | 12.31% |

| Index/ETF Inclusion | IFIX |

While the fund currently trades near book value (0.97x), its unit price has declined approximately 19% since inception, likely due to rising interest rates and the longer duration of its receivables. With a portfolio duration of 4.3 years, KNIP11 is more sensitive to changes in interest rates than funds holding short-term floating-rate assets, though less so than brick-and-mortar real estate FIIs. Since reaching a low in December 2024, the fund has recovered by around 6%.

Performance Track Record

Source: Google

Credit Portfolio

KNIP11 invests in higher-quality CRIs. As of July 1, management estimates that at a unit price of R$89.50, the portfolio offers a gross credit spread of IPCA + approximately 11.01%, resulting in a net spread of approximately 10.01% after fees. This equates to a 1.88% spread over the NTN-B (Brazilian government inflation-indexed bonds, similar to US TIPS).

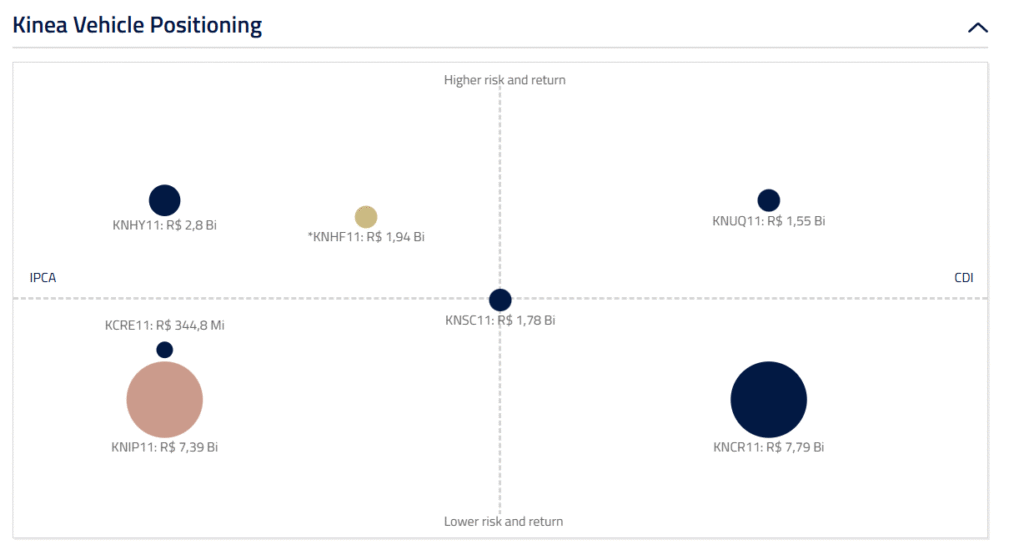

The chart below illustrates KNIP11’s position among other Kinea-managed funds. It sits in the lower-risk, lower-return quadrant, with large-scale exposure to inflation-linked (IPCA) instruments, in contrast to funds aligned to CDI-based structures.

Source: Kinea Website

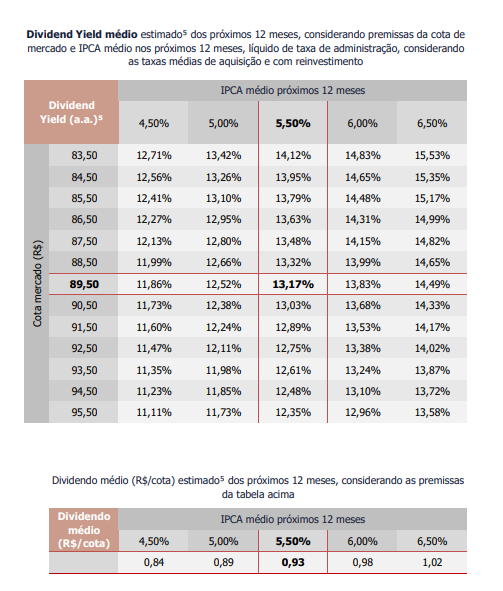

The table below shows management’s estimate of KNIP11’s dividend yield over the next 12 months, based on different assumptions for both the market price of the fund and the average IPCA inflation rate during the period. For example, if the fund is purchased at R$89.50 and average inflation is 5.5%, the estimated gross dividend yield is approximately 13.17% per year, or about R$0.93 per month per share.

Source: Kinea Website

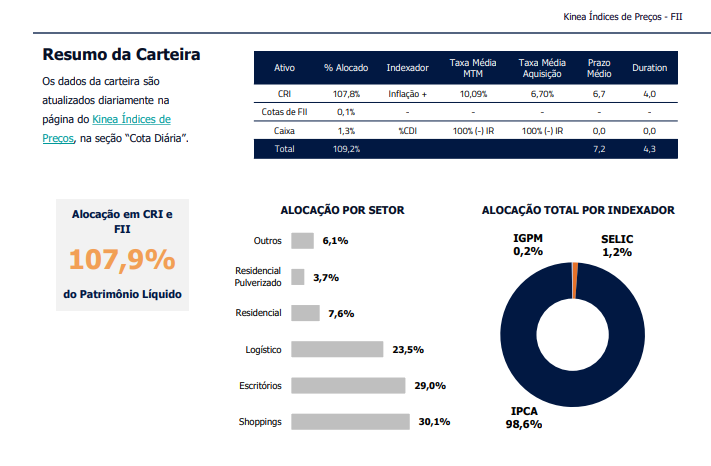

As of the end of May, KNIP11 had allocated 109.3% of its net assets across target instruments: 107.8% in inflation-linked CRIs, 1.3% in cash, and 0.1% in other FIIs. The portfolio’s average duration is 4.3 years, and no credit events were reported.

The slight over-allocation likely reflects accrued interest and mark-to-market adjustments common in CRI funds, rather than leverage or excess risk.

The fund’s largest exposures are to CRIs tied to Shopping Malls (30.1%), followed by Offices (29.0%) and Logistics (23.5%). The fund invests in Corporate CRIs, both with and without guarantees. Not all CRIs are collateralized; however, Kinea notes that exposures are limited to investment-grade issuers.

Source: Kinea May 2025 Management Report

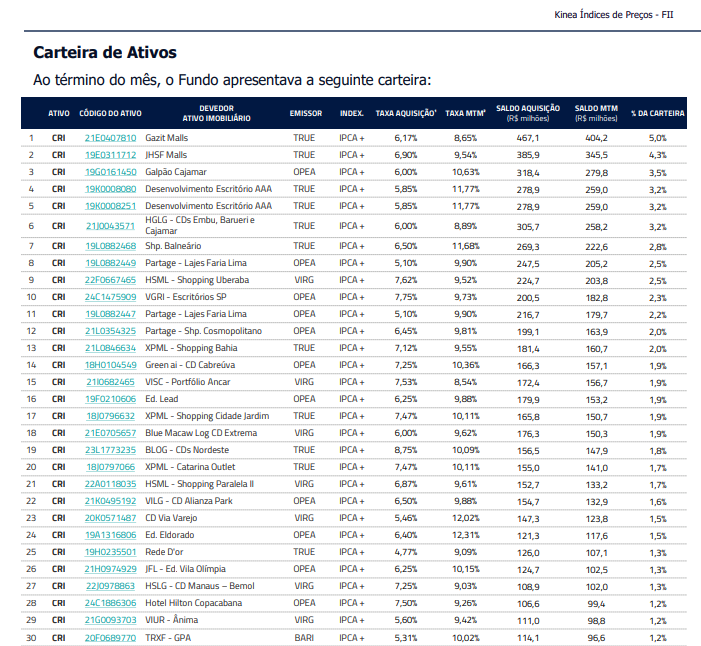

The fund currently holds a diversified portfolio of 114 CRIs, with the largest individual exposure being to Gazit Malls, which accounts for 5.0% of net assets. Some CRIs are also associated with other FIIs, particularly within the shopping mall and logistics sectors.

The table below lists KNIP11’s 30 largest CRIs by portfolio weight, illustrating both diversification and transparency. The remaining 82 instruments are also disclosed in full by Kinea but are excluded here for brevity.

Source: Kinea May 2025 Management Report

Potential risks in the portfolio include:

- A high concentration in office buildings (30% of the portfolio)

- A large number of maturities are 10 years or longer, with a few maturities in 20 years at the extreme, meaning circumstances could change materially prior to principal repayment

- Lack of third-party credit ratings, making risk harder to assess compared to rated debentures (e.g. those issued by utility companies and rated by S&P or Moody’s)

- Exposure to macroeconomic shocks, which have occasionally caused the fund to trade at a discount to NAV

The highest loan-to-value (LTV) ratio is 80%, though most are significantly lower, often below 50%. Nonetheless, a 30% exposure to Office CRIs could pose risk. Some markets, such as Rio de Janeiro, continue to struggle with low occupancy. It’s also worth noting that many office FIIs, including high-quality names like PVBI11, currently trade at book values below 0.75x.

Overall, Kinea is a reputable manager, and the fund has performed well historically. It offers a high level of transparency, disclosing detailed information on all CRIs held.

Sector Comparison & KPIs

📈 Market Cap & Yield

KNIP11 is the second-largest FII on the IFIX, with a market capitalization of R$7.1 billion. It offers a 12-month dividend yield of 12.31%, and 10.7% based on May’s distribution. Management estimates a forward yield of approximately 13%, based on the current unit price of R$89.11 and an expected IPCA inflation rate of 5.46%.

🧮 Valuation

KNIP11 trades at a price-to-book ratio of 0.97x, reflecting resilience and disciplined management amid a rising interest rate environment. Its portfolio duration is 4.3 years, which implies the fund’s market value would rise or fall by approximately 4.3% for every 1 percentage point change in long-term interest rate expectations, all else being equal.

💸 Dividend Pattern

KNIP11 has historically delivered a high and consistent dividend yield, with some monthly fluctuation which in particular is impacted based upon the official IPCA measure from the two months prior to distribution.

Historical annual accumulated IPCA rates are available here, and can be compared to the fund’s monthly distributions.

During periods of global stress (i.e. COVID), the fund performed very well as it maintained high real yields. Accumulated inflation was 10% in 2020 and nominal yields were particularly high in 2021. This compares to much lower returns distributed by KNCR11 (indexed to CDI) when the basic interest rate fell to 2% implying negative real rates. However, as real rates rose since 2022, KNCR11 has appreciated in value and delivered better distributions, while KNIP11 underperformed.

Due to inflation indexing and its longer duration, KNIP11’s interest rate exposure sits somewhere between KNCR11 (floating-rate) and brick-and-mortar funds (similar to coupon-only bonds).

👉 Scroll sideways on mobile to view the full chart

📘 Learn More

- If you’re new to Brazilian REITs (FIIs), check out my Guide for Global Investors or How I Choose FIIs

- For some great charts and graphs check out KNIP11’s page on Funds Explorer

🔗 Related Pages

Disclosure

As of this writing, I do not hold a position in KNIP11, though that may change in the future. This content is for informational purposes only and does not constitute financial advice. Always do your own research and consult a licensed advisor before making investment decisions.

IMPORTANT LEGAL DISCLAIMER

The information provided on this website is for general informational purposes only. All content is based on personal opinions, experience, or publicly available data, and is not intended as financial, legal, tax, or investment advice. Nothing here should be construed as a recommendation to buy, sell, or hold any financial instruments.

I am not a certified financial advisor, and I do not know your personal financial situation. Always consult with a qualified professional before making any investment decisions. Gringo Investor and its creator disclaim all liability for any loss or damage incurred as a result of reliance on this information.

Investing involves risks, including the potential loss of principal. Past performance is not indicative of future results.

This site is operated for an international audience and is not intended to comply with CVM regulations or provide formal investment recommendations in Brazil.