BTLG11 was launched in 2010 and is one of Brazil’s most established FIIs. It is currently the second-largest Logistics FII in the country, behind only HGLG11. Since 2019, the fund has been managed by BTG Pactual, a major investment manager affiliated with Banco BTG Pactual (BPAC11), one of Latin America’s largest investment banks and wealth managers.

BTLG11 is one of Brazil’s largest and most liquid REITs, with a market capitalization of R$4.3 billion. It represents 3.12% of the IFIX index and is the fourth-largest holding in the HERT11 ETF, with a 6.51% weighting.

Note that this page was last updated June 23, 2025.

BTLG11 Key Facts

| Metric | Value |

| Fund Name | BTG Pactual Logistica FII |

| Manager | BTG Pactual |

| Management Fee | 0.90% of market value |

| Manager Website | https://btlg.btgpactual.com/ |

| Inception | 03/08/2010 |

| Sector | Logistics |

| Market Cap | R$4.3B |

| Number of Properties | 34 Logistics Sites |

| Gross Leaseable Area (ABL) | ~1,300,000 square meters |

| Current Price | R$99.69 |

| Price-to-Book Value | 0.96 |

| Dividend Yield (Trailing 12M) | 9.41% |

| Index/ETF Inclusion | IFIX, HERT11 |

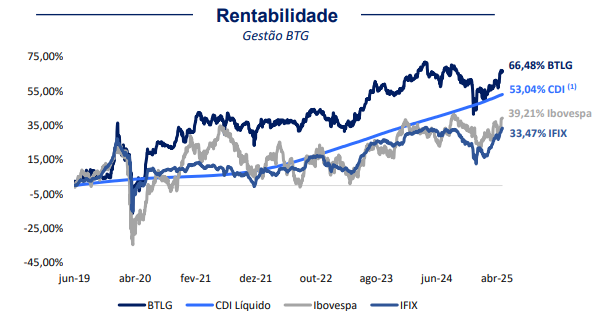

According to the May 2025 Management Report, BTLG11 has outperformed Brazil’s basic interest rate (CDI), the IFIX index, and the IBOVESPA benchmark since June 2019.

Performance Track Record

Source: May 2025 Management Report

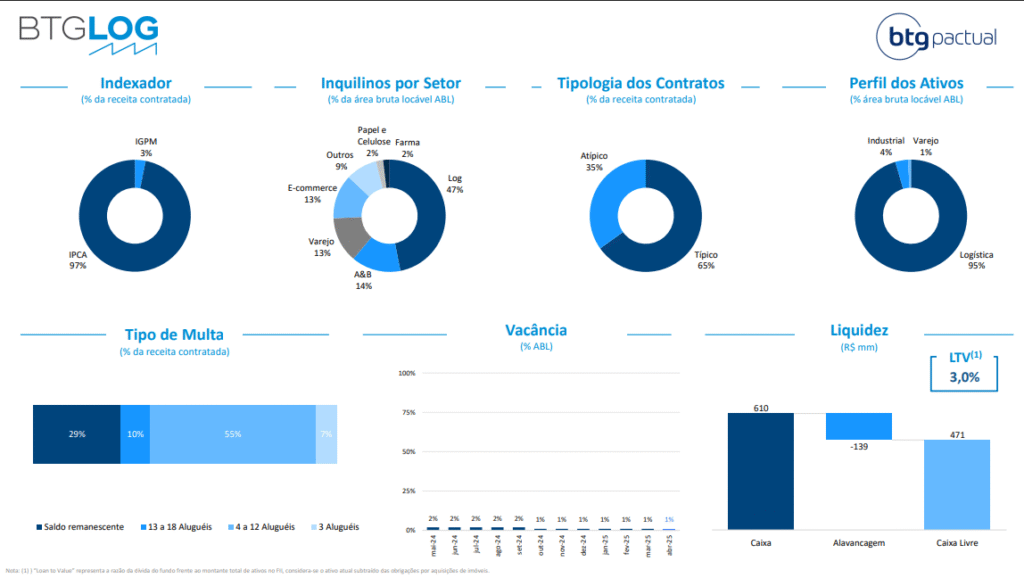

Portfolio Overview

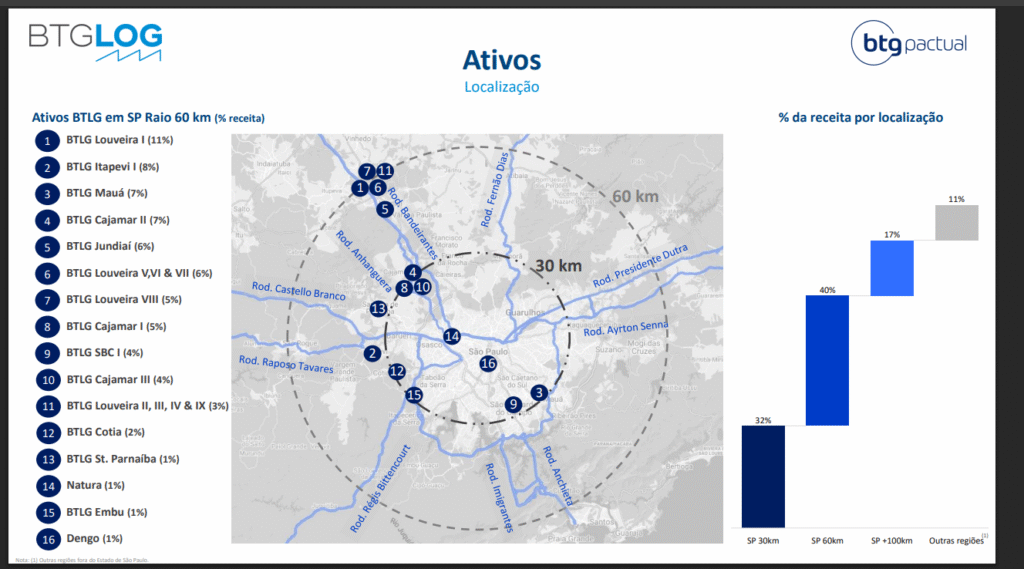

BTG Pactual Logística FII holds a diversified portfolio of 34 logistics properties, totaling approximately 1.3 million square meters of Gross Leasable Area (Área Bruta Locável, or ABL). The fund targets high-density logistics hubs, with 90% of its ABL located in the State of São Paulo and 72% within 60 km of the capital. Its acquisition strategy focuses on A+ grade assets.

The table below shows BTLG11’s properties that are located close to Sao Paulo.

Source: Management Presentation

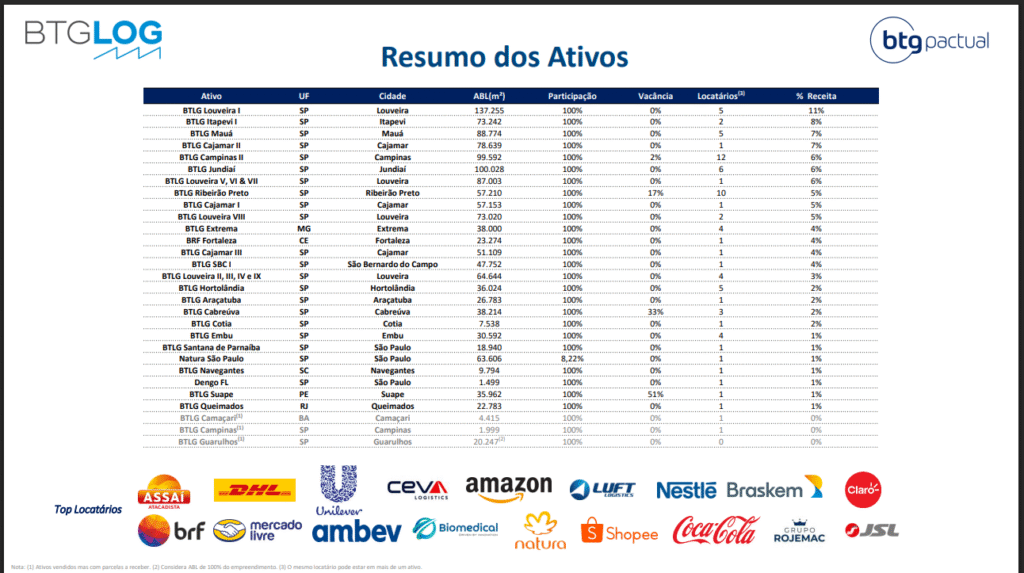

The table below lists BTLG11’s largest holdings by Gross Leasable Area (ABL), including each property’s name, location, ownership percentage, and share of the fund’s total rental income. It also shows vacancy rates and tenant count per asset. In nearly all cases, BTLG11 holds full ownership of the properties.

Source: Management Presentation

Sector Comparison & KPIs

BTLG11 is currently the second-largest logistics FII on the IFIX, trailing only HGLG11 in size.

With a 12-month dividend yield of 9.41%, BTLG11 trails the logistics FII median of 9.88% by 47 basis points. However, due to its scale and track record, it’s more appropriately benchmarked against top-tier logistics peers like HGLG11, XPLG11, and BRCO11.

Its price-to-book ratio of 0.96x is well above the IFIX logistics peer median (0.80x) and broadly consistent with other top funds: HGLG11 (0.98x), XPLG11 (0.92x), and BRCO11 (0.92x).

BTLG11 has maintained steady dividend distributions over the past five years. However, its dividend growth has been modest, with a compound annual growth rate (CAGR) of just 2.4% between 2022 and 2024, lagging behind inflation.

👉 Scroll sideways on mobile to view the full chart