Launched in 2010, KNRI11 is Brazil’s largest hybrid real estate FII and the fourth largest brick-and-mortar fund overall. Its portfolio is nearly evenly split between office and logistics assets, with 54% of rental income from offices and 46% from logistics.

Managed by Kinea Investimentos, the fund has a market capitalization of approximately R$4.1 billion. It represents 2.96% of the IFIX index and carries a weight of 6.59% in the HERT11 ETF.

Note that this page was last updated June 25, 2025.

KNRI11 Key Facts

| Metric | Value |

| Fund Name | Kinea Renda Imobiliaria FII |

| Manager | Kinea Investimentos |

| Management Fee | 1.11% of Market Capitalization |

| Manager Website | https://www.kinea.com.br/fundos/fundo-imobiliario-kinea-renda-knri11/ |

| Inception | 11/08/2010 |

| Sector | Hybrid (Offices 54%, Logistics 46%) |

| Market Cap | R$4.1B |

| Number of Properties | 21 (13 Offices & 8 Logistics Sites) |

| Gross Leaseable Area (ABL) | ~722K sqm. (Offices: 167K, Logistics: 555K) |

| Current Price | R$142.30 |

| Price-to-Book Value | 0.89 |

| Dividend Yield (Trailing 12M) | 8.37% |

| Index/ETF Inclusion | IFIX, HERT11 |

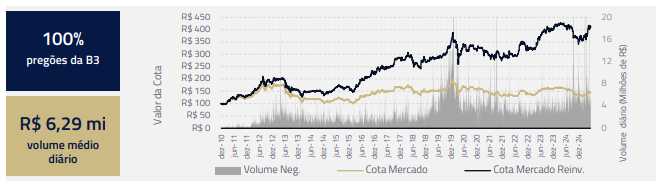

The chart below, provided by Kinea, shows KNRI11’s total return with dividends reinvested since inception. While informative, it does not include a benchmark index such as the IFIX, making direct performance comparisons more difficult.

Performance Track Record

Source: May 2025 Management Report

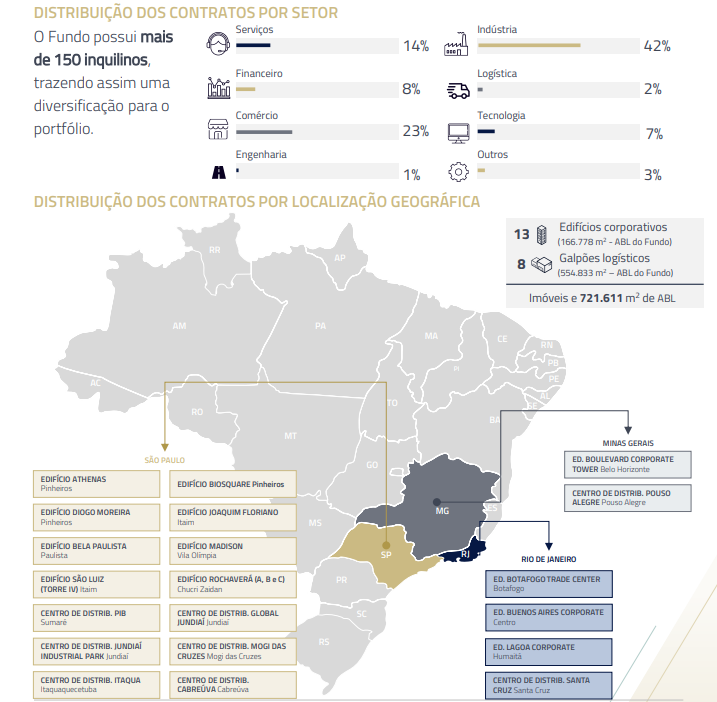

Portfolio Overview

KNRI11’s portfolio consists of 21 properties totaling approximately 722 thousand square meters of Gross Leasable Area (GLA), split between 13 office buildings (167 thousand sqm) and 8 logistics properties (555 thousand sqm).

The infographic below illustrates the fund’s tenant sector diversification. Although KNRI11 holds properties in just three states, rental income is heavily concentrated in São Paulo (69%), followed by Rio de Janeiro (16%) and Minas Gerais (15%).

Source: May Management Presentation

70% of KNRI11’s leases are indexed to IPCA, and 30% to IGP-M, meaning all contracts are tied to inflation, a common feature of Brazilian FIIs.

Leases are roughly balanced between ‘typical’ (54%) and ‘atypical’ (46%). While atypical leases offer higher contractual security, they may also reflect more specialized properties, potentially increasing vacancy risk in the event of tenant insolvency.

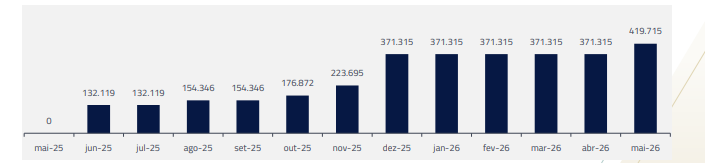

The fund granted substantial grace periods to attract tenants. Although this suggests some weakness in the rental market for its properties, it also creates a significant revenue opportunity as those grace periods expire. The table below shows Kinea Investimentos’ projections for incremental revenue gains once the grace periods come to an end.

Source: May Management Presentation

Sector Comparison & KPIs

📈 Market Cap & Yield

KNRI11 is the fourth largest brick-and-mortar FII on the IFIX, with a market capitalization of R$4.1B. It offers a 12-month dividend yield of 8.37%, below both the logistics FII median of 9.88% and offices FII median of 12.09%. Due to its scale, track record, and hybrid portfolio, it is best compared to a weighted blend of top-tier office funds like PVBI11 and HGRE11 alongside logistics peers such as HGLG11 and BTLG11.

🧮 Valuation

KNRI11 trades at a price-to-book ratio of 0.89x, above both the IFIX offices peer median of 0.73x and the logistics peer median of 0.80x. It trades above large office FIIs such as PVBI11 and HGRE11 (both 0.73x), but below logistics peers like HGLG11 (0.97x), BTLG11 (0.96x), and BRCO11 (0.92x).

💸 Dividend Pattern

KNRI11 has historically delivered consistent monthly dividends, and in recent years those have grown at or above the rate of inflation. For instance, dividends growth achieved a CAGR of 6.9% between 2022 and 2024.

While the payout remained resilient during COVID, the current R$1.00 monthly dividend is just 9% above the R$0.92 paid in 2016, indicating that long-term nominal growth has been limited.

👉 Scroll sideways on mobile to view the full chart

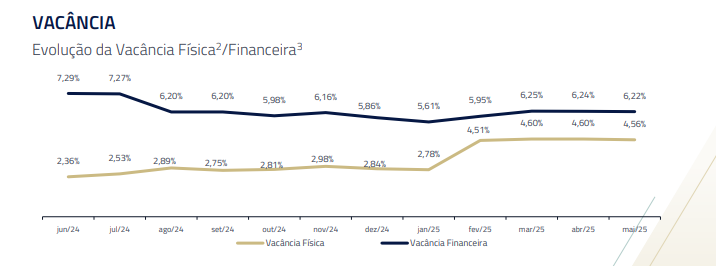

📉 Vacancy & Lease Profile

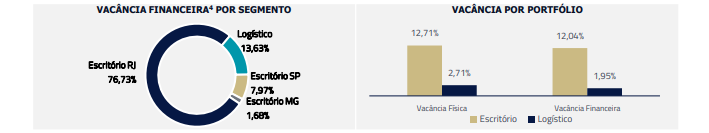

As of May, 2025 KNRI11 has a physical vacancy rate of 4.56% and a financial vacancy rate of 6.22%. Financial vacancy has improved over the past 12 months, likely due to expiring grace periods, while physical vacancy has gradually increased.

Source: Kinea Renda Imobiliaria FII – May Report

The average remaining lease term is 3.03 years for offices and 4.53 years for logistics assets. In the logistics segment, this is broadly in line with HGLG11 (4.6 years) but shorter than BTLG11 (5.2 years).

Logistics vacancy is favorable, with less than 2% financial vacancy, comparing well to HGLG11 (5.5%) and BTLG11 (1%).

However, the office portfolio shows a 12% financial vacancy rate, with 76.73% of that concentrated in Rio de Janeiro.

While only 10% of office leases are set to expire by the end of 2026, an additional 16% come due in 2027.

Source: Kinea Renda Imobiliaria FII – May Report

📘 Learn More

- If you’re new to Brazilian REITs (FIIs), check out my Guide for Global Investors or How I Choose FIIs

- For some great charts and graphs check out KNRI11’s page on Funds Explorer

🔗 Related Pages

- Brazilian Offices FIIs Overview

- Brazilian Logistics FIIs Overview

- IFIX Index Composition

- HERT11 ETF Holdings

Disclosure

As of this writing, I do not hold a position in KNRI11, though that may change in the future. This content is for informational purposes only and does not constitute financial advice. Always do your own research and consult a licensed advisor before making investment decisions.

IMPORTANT LEGAL DISCLAIMER

The information provided on this website is for general informational purposes only. All content is based on personal opinions, experience, or publicly available data, and is not intended as financial, legal, tax, or investment advice. Nothing here should be construed as a recommendation to buy, sell, or hold any financial instruments.

I am not a certified financial advisor, and I do not know your personal financial situation. Always consult with a qualified professional before making any investment decisions. Gringo Investor and its creator disclaim all liability for any loss or damage incurred as a result of reliance on this information.

Investing involves risks, including the potential loss of principal. Past performance is not indicative of future results.

This site is operated for an international audience and is not intended to comply with CVM regulations or provide formal investment recommendations in Brazil.