Launched in 2019, HSML11 is Brazil’s fourth-largest shopping mall real estate investment fund (FII), ranking behind XPML11, VISC11 and HGBS11, and ahead of MALL11. It is managed by HSI Investimentos, an alternative asset manager overseeing R$13.1B, with 245,000 investors. It represents 1.26% of the IFIX index and carries a 2.87% weight in the HERT11 ETF.

Last Updated: July 6, 2025.

HSML11 Key Facts

| Sector | Shopping Malls |

|---|---|

| Market Cap | R$1.8B |

| Price-to-Book | 0.78x |

| Dividend Yield (12M) | 10.29% |

| Recurring Yield (Est.) | ~8% |

| Dividend CAGR (19-24) | N/A |

| Leverage | 18.6% |

| Current Price | R$84.57 |

| Vacancy Rate | 4.3% |

| Index/ETF Inclusion | IFIX, HERT11 |

| LTM Avg. Daily Trading Volume | R$3.4M |

View Full Metrics

| Fund Name | HSI Malls Fundo de Investimento Imobiliário |

|---|---|

| Manager | HSI Investimentos |

| Manager Website | hsml.hsifii.com |

| Management Fee | 1.05% p.a. + bookkeeping fee |

| Performance Fee | 20% above IPCA + 6% |

| Auditor | PwC |

| Appraiser | Colliers |

| Management Report Accounting | Cash Basis |

| Inception | July 31, 2019 |

| Number of Properties | 7 Malls |

| Book Value Cap Rates | 8.50% – 9.50% |

| Gross Leasable Area | ~179,800 square meters |

| Market Value per m² | ~R$12,400 |

| NOI per m² (2024) | R$1,352 |

| NOI Growth (2024/2023) | +10% |

| Sales per m² | R$17,588 |

| SSS Growth (2024/2023) | +7.0% |

| SSR Growth (2024/2023) | +5.4% |

| Div Guidance (through June) | R$0.65 – R$0.82 |

| Undistributed Result (May) | R$0.85 |

Performance Snapshot

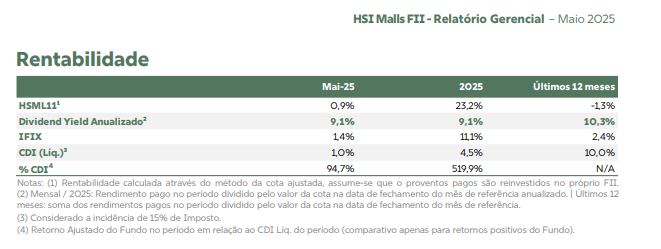

Over the past 12 months, HSML11 has returned –1.3%, underperforming the IFIX index, which gained 2.4%. In 2025, however, the fund recovered strongly, with a total return of 23.2% through the end of May, compared to 11.1% for the IFIX.

Source: HSI Investimentos – HSML11 May 2025 Management Report

The latest management reports do not provide a full long-term performance comparison. Since inception, the fund’s market price has declined approximately 17%. However, the figure below does not include dividends, so the total return over the full period is much higher. In the absence of complete historical data, investors should assume that the fund underperformed both the IFIX and the CDI since inception.

Data Source: Google Finance, as of July 6, 2025

Portfolio Overview

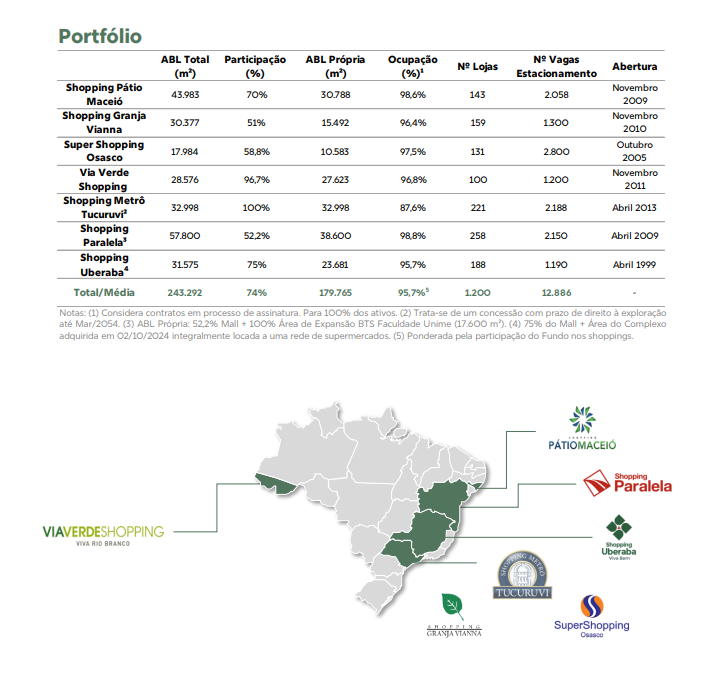

HSML11’s portfolio includes interests in seven shopping centers, with proportional ownership totaling approximately 179,800 square meters of Gross Leasable Area (GLA). The assets are relatively young and offer potential for real growth above the national average.

The fund maintains a controlling interest in all of its properties, with ownership levels above 50% and an average stake of 74%. Across the portfolio, there are 1,200 stores.

Compared to many other shopping FIIs, HSML11 has a lower geographic concentration in São Paulo. Just 32.9% of its ABL and 31% of its NOI come from the state. This is comparable to VISC11, which derives 32% of its NOI from São Paulo, but lower than XPML11 (approximately 50% of ABL) and HGBS11 (86%).

The remaining ABL is diversified across other regions. Approximately 21.5% is located in Salvador, Bahia, an important capital in the Northeast. Another 17.1% is in Maceió, also in the Northeast. Acre accounts for 15.4% of ABL, followed by 13.2% in Minas Gerais, a relatively affluent mining state.

Because the fund’s portfolio is less concentrated in São Paulo, many of its assets require higher cap rates. However, according to Itaú, the fund tends to own dominant malls within each market, with strong tenant retention and a high share of income coming from predictable base rents.

Source: HSI Investimentos – HSML11 May 2025 Management Report

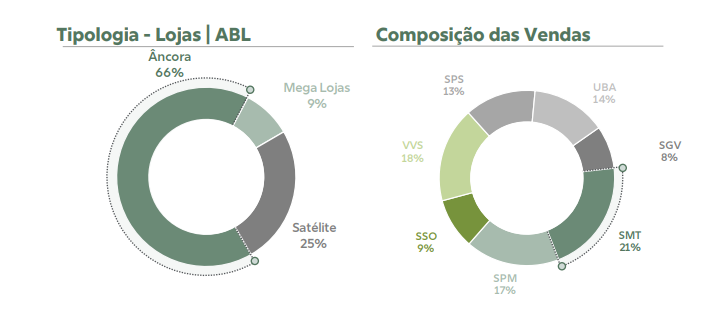

HSML11’s malls benefit from a strong tenant mix that helps drive traffic. Anchor tenants (defined as stores with more than 1,000 square meters) occupy 66% of total leasable area.

The charts below illustrate the breakdown of ABL by tenant type and the composition of sales across the portfolio.

Source: HSI Investimentos – HSML11 May 2025 Management Report

All seven malls in the portfolio are operated by Alqia, a property manager that is part of the HSI group. Although this structure may raise concerns about potential conflicts of interest, it also enables tighter operational alignment between asset manager and property operator.

Recent initiatives by the group include repositioning Shopping Metrô Tucuruvi as a gastronomic destination and converting a theater into two VIP cinema rooms at Shopping Paralela. These efforts aim to attract higher-quality clientelle, increase foot traffic and strengthen sales performance.

Valuation Metrics & Peer Comparison

📈 Market Cap & Yield

HSML11 is the fourth largest shopping mall FII in the IFIX, with a market capitalization of R$1.8B. It delivered a 12-month dividend yield of 10.29%, slightly below the median yield of 10.88% for shopping FIIs. However, it is most appropriately compared to top-tier peers such as XPML11, HGBS11, VISC11, and MALL11, which have a median 12-month dividend yield of 9.78%.

Based on the most recent monthly distribution of R$0.65 per unit, the current dividend yield is 9.2%.

I estimate that the fund can continue distributing around 8% from recurring income. This excludes non-recurring items such as capital gains and accrued interest expenses not recognized under a cash accounting regime.

🧮 Valuation

HSML11 is currently trading at a price-to-book ratio of 0.78x. This is lower than the IFIX shopping sector median of 0.80x and below the 0.87x median for larger shopping FIIs.

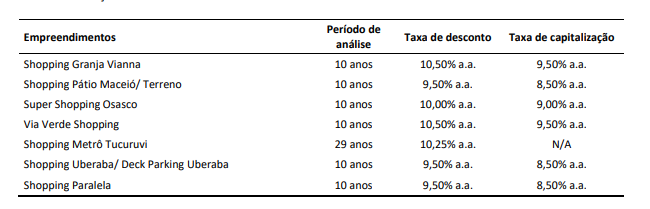

In its most recent annual report (as of June 30, 2024), Colliers International applied discount rates ranging from 8.50% to 9.50% across the fund’s properties, as summarized in the table below.

Source: HSML11 Annual Report, June 30, 2024, page 23.

HSML11’s assets were revalued upward by 13.6%, which highlights the quality of its underlying real estate, the potential for further value creation, and HSI’s active approach to portfolio management.

💸 Dividend Trends & Guidance

Because the fund began in 2019, it is difficult to compare the long-term trend of dividends due to the absence of a pre-COVID baseline. The fund has paid consistent dividends since the end of COVID, but the distribution of non-recurring gains related to the sale of a 30% interest in Shopping Pátio Maceió in December 2023 makes it difficult to identify a clear pattern.

In 2024, the fund paid R$0.80 per month in distributions. However, R$2.43 of that total (equivalent to about R$0.20 per month) was attributable to the non-recurring capital gain from the 2023 sale. An additional R$1.57 per month is projected to be included in the 2025 results.

Excluding capital gains, I estimate income at R$0.67 per month in 2022, R$0.72 per month in 2023, and R$0.60 per month in 2024. However, the 2023 figure excludes R$45 million of accrued interest, since the accounting is done on a cash basis. Adjusting for that, the recurring result was closer to R$0.53 per month. 2024 results reflect a more realistic assessment of debt costs and were also affected by the issuance of new shares, which diluted unitholders but helped reduce the fund’s leverage.

Using a baseline recurring yield expectation of approximately 8%, HSML11 appears well-positioned to deliver a healthy and growing inflation-adjusted dividend in future years, supported by improving operating performance and ongoing deleveraging.

The fund expects to receive R$0.73 from non-recurring capital gains during the remainder of 2025 and currently holds R$0.85 of undistributed earnings.

👉 Scroll sideways on mobile to view the full chart

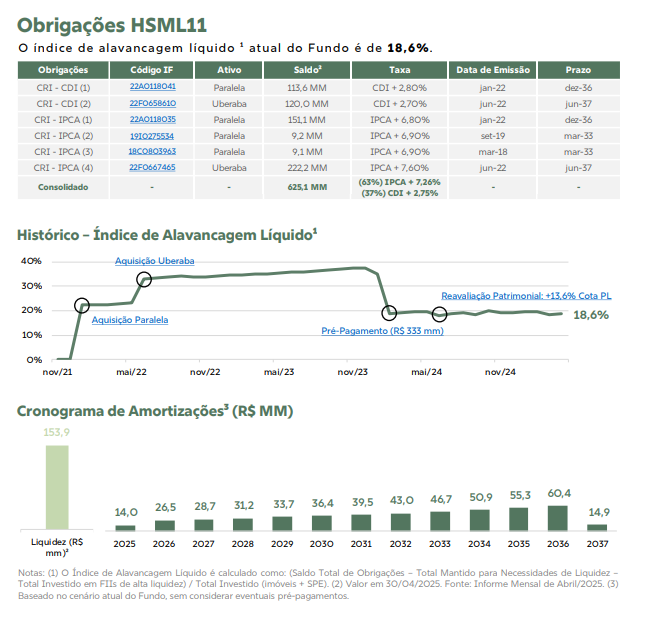

🩸Debt Position

HSML11 has significant leverage at 18.6%, or R$625 million gross and R$465 million net, related to shopping mall acquisitions in 2022. Gross debt of over R$900M was reduced by R$332 million in 2024 as part of a new equity issuance. While leverage continues to weigh on recurring results, the repayment schedule is now quite manageable.

The interest expense reported in the May management report, totalling R$6.06 million, appears to more accurately reflect R$465 million of net debt. This implies an interest rate of approximately 15.7%, which is plausible given the CDI was 14.7% during the month of May.

Source: HSI Investimentos – HSML11 May 2025 Management Report

Key Operating Metrics

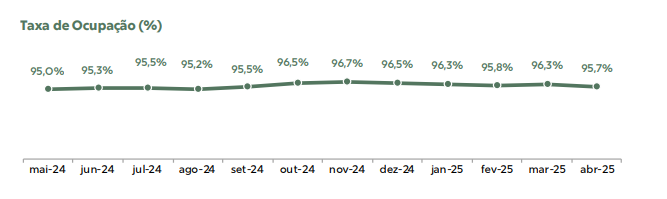

📉 Vacancy

Vacancy has remained relatively stable at 4.3%, which is roughly in line with peers.

Source: HSI Investimentos – HSML11 May 2025 Management Report

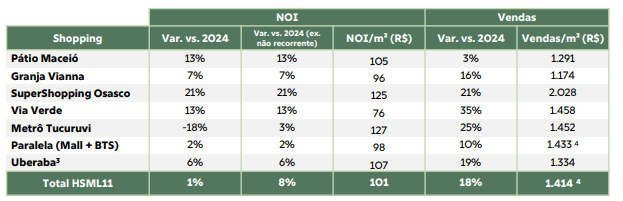

🛒 Retail KPIs: NOI, SSS, SSR & Sales/m²

This section highlights retail-specific performance indicators, such as rental efficiency, income growth, and consumer activity.

HSML11 posted strong results, with Net Operating Income (NOI) increasing 10% from 2023 to 2024 and Same-Store-Sales (SSS) rising 7%. More recently, NOI grew 8% year-over-year in April, and sales rose 18%. After adjusting for seasonality by combining March and April (to include Easter in both years), sales increased 11%.

Source: HSI Investimentos – HSML11 May 2025 Management Report

Same-Store-Rent (SSR) also rose by 5.4% in 2024.

These indicators reflect a strong mall portfolio, effective active management by HSI, and the fund’s ability to maintain low vacancy while keeping rental income growth aligned with or above inflation.

Recent Events

- February 2024: Concluded the sale of a 30% interest in Shopping Pátio Maceió at a cap rate of 7.50%. The fund received 25% of the proceeds upfront, with the remaining payments to be received over time and adjusted for inflation. A small final payment (8.34%) is expected in September 2025, contributing R$0.93/unit, of which R$0.44/unit is distributable profit. A larger payment (40%) is expected in July 2027 unless HSML11 exercises its buyback option, which begins in early 2026. A portion of the proceeds was used to reduce leverage.

- February 2024: Completed a new equity issuance, raising funds to repay R$332M of outstanding CRIs and reduce leverage.

- May 2024: Acquired a 6,464 m² area within the Shopping Uberaba complex for R$41M, representing a cost of R$6,345/m², about a 60% discount to the fund’s book value per square meter.

- June 2024: Exercised an option to purchase 632 additional parking spaces and 21,660 square meters for R$44M, as part of the phased Shopping Uberaba expansion.

- November 2024: Sold a 25% interest in Shopping Uberaba (including newly acquired areas) for R$146M, with 35% received upfront and the remainder payable over time, indexed to inflation. The sale generated a capital gain of R$2.05/unit (excluding monetary adjustment), with income of R$0.29 expected to be received in November 2025.

Broker Insights

- HSML11 is one of two shopping mall FIIs included in Itau’s recommended wallet, alongside XPML11, and with a 7.5% allocation.

- On the positive side, Itaú highlights that HSML11 holds controlling positions in dominant regional assets, with a large share of revenue coming from recurring monthly lease payments. The bank also noted operating improvements during 2024.

- On the negative side, Itaú pointed to elevated vacancy at Shopping Metrô Tucuruvi and the fund’s overall leverage.

- Among 10 shopping FIIs, Itaú rated HSML11 a ‘buy’, alongside XPML11, VISC11, and HGBS11. The remaining funds received ‘neutral’ ratings.

- As of July 6, 2025, BTG has a ‘buy’ recommendation and target price of R$123 (+45%).

📘 Learn More

- If you’re new to Brazilian REITs (FIIs), check out my Guide for Global Investors or How I Choose FIIs

- For additional charts and graphs, visit HSML11’s page on Funds Explorer

🔗 Related Pages

Disclosure

I currently hold a long position in HSML11 and may increase my allocation in the future. This content is for informational purposes only and does not constitute financial advice. Always do your own research and consult a licensed advisor before making investment decisions.

IMPORTANT LEGAL DISCLAIMER

The information provided on this website is for general informational purposes only. All content is based on personal opinions, experience, or publicly available data, and is not intended as financial, legal, tax, or investment advice. Nothing here should be construed as a recommendation to buy, sell, or hold any financial instruments.

I am not a certified financial advisor, and I do not know your personal financial situation. Always consult with a qualified professional before making any investment decisions. Gringo Investor and its creator disclaim all liability for any loss or damage incurred as a result of reliance on this information.

Investing involves risks, including the potential loss of principal. Past performance is not indicative of future results.

This site is operated for an international audience and is not intended to comply with CVM regulations or provide formal investment recommendations in Brazil.