XPML11 is one of Brazil’s largest real estate investment funds (FIIs), focused on high-traffic shopping malls across the country. Managed by XP Asset, the fund is known for consistent dividends and exposure to Brazil’s consumer economy.

XPML11 is the largest and most liquid shopping mall FII in Brazil, with a market capitalization of R$5.9 billion and a 4.19% weighting in the IFIX index. It is the third-largest component of the IFIX index, the largest component of the HERT11 ETF, and the largest among all brick-and-mortar FIIs.

Note that this page was last updated June 22, 2025.

XPML11 Key Facts

| Metric | Value |

| Fund Name | XP Malls Fundo de Investimento Imobiliario |

| Manager | XP Asset Management |

| Management Fee | 0.75% of AUM + 20% performance fee (>IPCA + 6%) |

| Manager Website | https://www.xpasset.com.br/fundos/xp-malls/ |

| Inception | 27/12/2017 |

| Sector | Shopping Malls |

| Market Cap | R$5.9B |

| Number of Properties | 29 Malls |

| Gross Leaseable Area (ABL) | ~330,000 square meters |

| Current Price | R$101.19 |

| Price-to-Book Value | 0.89 |

| Dividend Yield (Trailing 12M) | 10.58% |

| Index/ETF Inclusion | IFIX, HERT11 |

Portfolio Overview

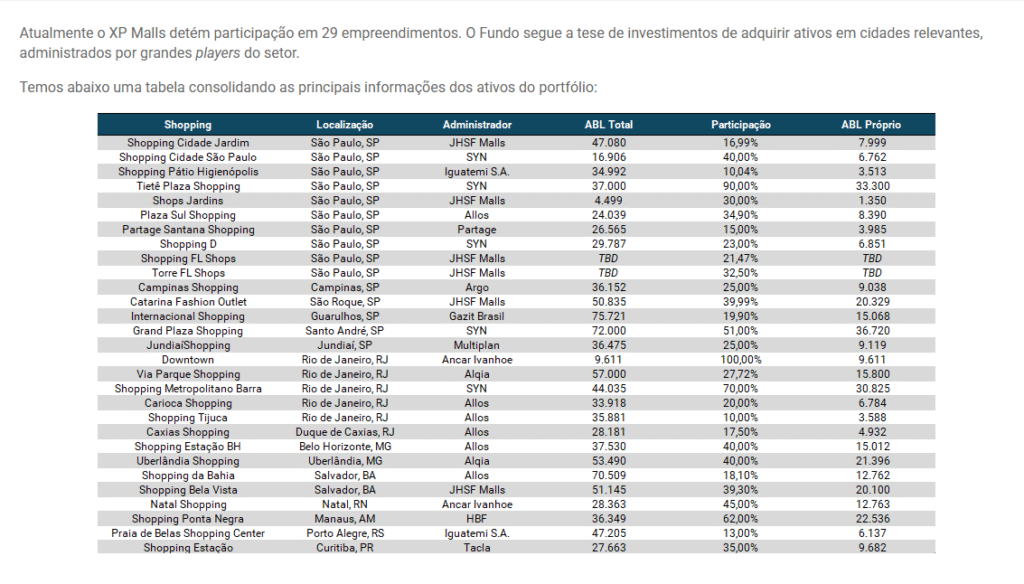

XP Malls holds a diversified portfolio of 29 high-traffic shopping centers across Brazil, with total exposure to approximately 330,000 square meters of gross leasable area (ABL). In many cases, the fund owns minority stakes, typically below 50%.

The table below lists XPML11’s top holdings by ABL, showing the name of the mall, city, total ownership percentage, and each property’s share of the portfolio’s total ABL.

Source: Fund website. June 22, 2025.

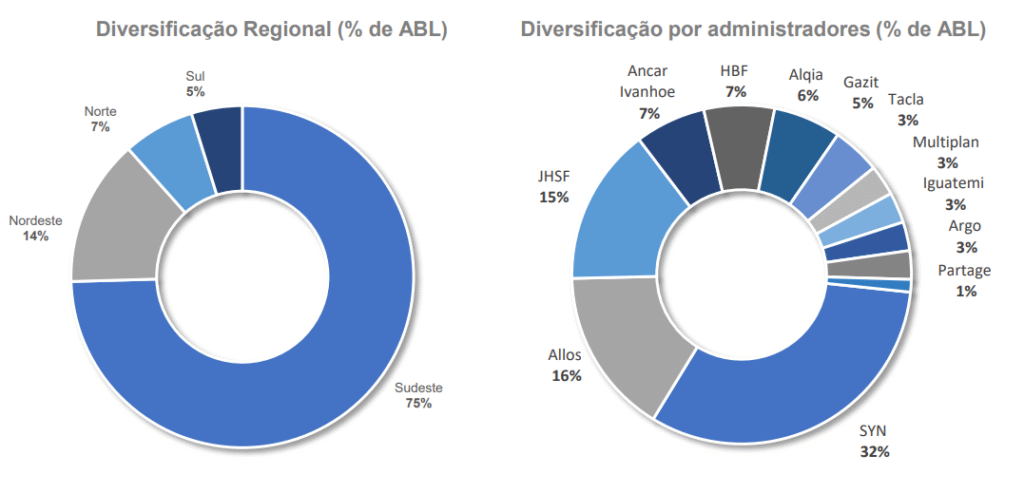

Roughly half of XPML11’s leasable area is concentrated in the state of São Paulo, while the remainder is spread across seven other states, including regions in the Northeast, South, and North of Brazil. From an operational standpoint, the portfolio is also diversified by property manager, although SYN is responsible for over 30% of the total ABL.

Regional Exposure & Manager Diversification

Source: XPML11 April 2025 Management Report

XPML11’s regional tilt toward the Southeast aligns with its strategy of targeting economically robust areas with dense retail activity. While SYN oversees the largest share of the portfolio by ABL, the presence of other major operators, including Allos, JHSF, and Iguatemi, adds diversification in management approach and strengthens the fund’s bargaining position.

Sector Comparison & KPIs

XPML11 is the largest of 10 shopping mall FIIs listed on the IFIX. Its scale allows for a dedicated team of 4 analysts, 4 engineers, and a controller, a level of staffing rarely available to smaller funds.

XPML11’s 12-month dividend yield of 10.58% is 31 bps below the shopping FII median (10.89%). But given its size, it’s better benchmarked against peers like VISC11 and HGBS11.

XPML11s price-to-book value of 0.89x is above the median of its IFIX peers (0.80x), but less than HGBS11 (0.91x) and more than VISC11 (0.83x).

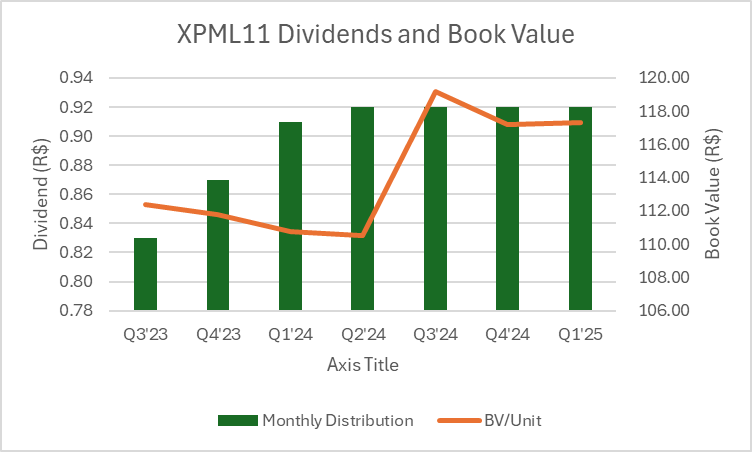

Aside from the COVID period, XPML11 has delivered consistent, inflation-beating dividends since 2019, despite several follow-on offerings. In fact, its dividend grew by a CAGR of 9.2% between 2019 and 2024.

👉 Scroll sideways on mobile to view the full chart