Table of Contents

- Fund & Portfolio Overview

- Dividend History & Sustainability

- Future Outlook & Operational KPIs

- Final Verdict

- Disclosure & Legal Disclaimer

HGBS11 is one of Brazil’s largest and most liquid FIIs, providing exposure to a diversified portfolio of shopping centers. However, its monthly dividend has declined from R$0.20 at the end of 2023 to R$0.16 in 2025, a level that currently exceeds the fund’s recurring earnings.

In this article, we evaluate the quality of HGBS11’s assets, analyze recent earnings trends, assess the consistency of its dividends, and explore key risks to help you decide whether it still deserves a place in your portfolio.

Fund & Portfolio Overview

Launched in 2006 by Hedge Investments, HGBS11 was one of Brazil’s first multi-asset shopping FIIs and played a key role in establishing the segment as a core part of the local real estate market. It also stands out internationally as Brazil’s first member of the US-based National Association of Real Estate Investment Trusts (Nareit), expanding its outreach to foreign investors through presentations in English. HGBS11 is currently the only Brazilian REIT rated by S&P.

Today, HGBS11 is the third-largest shopping mall FII in Brazil, with a market capitalization of approximately R$2.5 billion and a 1.81% weighting in the IFIX. For comparison, its main peers have the following index weights: XPML11 at 4.27%, VISC11 at 2.14%, HSML11 at 1.27%, and MALL11 at 1.02%. For the average retail investor, HGBS11 offers a large and liquid vehicle for exposure to the shopping center segment.

Hedge Brasil Shopping FII holds a diversified portfolio of 20 shopping malls, totaling approximately 245,000 square meters of Área Bruta Locável (ABL). The fund focuses on acquiring stakes in malls with at least 15,000 square meters of ABL, managed by experienced and specialized operators. In many cases, HGBS11 holds minority ownership positions rather than full control.

Source: HGBS11 Spreadsheet found at their website.

At current prices, HGBS11 trades at just over R$10,000 per square meter of ABL, roughly half the valuation of XPML11. This suggests a portfolio that sits below the top tier in terms of asset pricing, despite its scale and diversification.

With 86% of HGBS11’s portfolio allocated to the state of São Paulo, the fund is concentrated in Brazil’s most premium retail market. Operationally, half of the portfolio is managed by ALLOS.

This regional concentration reflects the fund’s strategy of focusing on economically stronger regions with higher retail density. However, the large exposure to a single operator like ALLOS introduces some risk related to negotiation leverage and operational dependency.

HGBS11 charges a relatively low management fee of 0.6% of market value, with no incentive bonus. While this structure is simple and transparent, the market-value basis introduces a different set of incentives compared to traditional AUM-based fees.

On December 19, 2024, HGBS11 completed its acquisition of a 25% stake in Shopping Jaraguá Araraquara for R$63 million, at a cap rate of 9.1%. Notably, the fund projected NOI to grow by 31% over the following four years, suggesting growth above inflation. At the end of 2023, the fund also acquired a 65% stake in Boulevard Shopping Bauru for R$152 million, at an estimated cap rate of 9%.

In terms of divestments, the fund sold its 30.625% stake in I Fashion Outlet Novo Hamburgo (IFONH) at a cap rate of 7.5%, based on 2023 NOI. This sale enabled the fund to distribute up to R$4.19 per share in realized profits.

The fund manager has stated that it aims to create shareholder value through asset recycling. This approach appears to be supported by recent transactions, with acquisitions occurring at cap rates around 9% and divestments near 7.5%, indicating positive value realization.

However, this recycling strategy comes with caveats, which are discussed in the next section. Additionally, because the fund charges a fee based on market value rather than net asset value or AUM, there may be a greater incentive to sustain short-term share prices through elevated headline yields.

In the sections that follow, I’ll break down HGBS11’s long-term outlook. You can also read my detailed methodology for choosing the best FIIs here.

Dividend History & Sustainability: Is HGBS11’s Yield Set to Decline?

HGBS11 paid as much as R$0.20 per share in the second half of 2023, but currently distributes R$0.16 per month. The chart below from Funds Explorer is somewhat difficult to interpret, likely due to HGBS11’s recent 10-for-1 stock split, which has compressed the historical data visually.

Source: Funds Explorer

Based on a current unit price of R$19.41, HGBS11’s headline dividend yield is 9.9% using last month’s distribution. The fund has distributed a total of R$1.95 over the past 12 months, resulting in a trailing 12-month yield of 10.0% percent.

However, the fund distributed profits from asset sales and only generated an average monthly income of R$1.35 per unit in recurring earnings during 2024. This implies a sustainable dividend yield of 8.3%. Management has forecast a dividend of R$1.60 through the end of June 2025, and it seems likely that additional asset recycling would be needed to maintain this level.

The table below illustrates how important non-recurring results have been for HGBS11’s distributions.

Source: HGBS11 March 2025 Management Report

Let’s dig a bit deeper into HGBS11’s recent dividends, sales, and acquisitions to better understand sustainability.

In 2019, before COVID, HGBS11 paid R$0.14 for 11 months and R$0.20 in one month, for a total distribution of R$1.74. During the trailing 12 months, HGBS11 has paid R$1.95, representing growth of only 11.4% over nearly six years, which is below the rate of inflation. The fund paid R$1.633 in 2013, which is equivalent to approximately R$3.21 today, meaning investors who bought and held without reinvesting dividends have lost nearly 40% of their purchasing power.

Source: Banco Central Brasil IPCA Calculator

This suggests two things: (1) new issuances have been dilutive, and (2) asset recycling has not led to sustainable dividend growth.

The first issue is relatively straightforward. Although new issuances expanded ABL from 105,000 square meters in 2019 to 245,000 today, this expansion did not translate into inflation-adjusted dividend growth on a per-unit basis.

Asset recycling has also been a consistent part of the fund’s strategy. 20% of last year’s result came from non-recurring sales, and 14% the year before. Prior to COVID, this was also a common practice.

If HGBS11’s asset recycling strategy were consistently beneficial to shareholders, we would expect to see dividends rising in line with inflation over time, with occasional one-off distributions reflecting particularly profitable divestments.

What seems to be happening is that HGBS11 sells assets that have appreciated primarily due to inflation and distributes the resulting gains to investors. This may erode the portfolio’s long-term income-generating capacity. The high headline yield helps sustain a stronger market valuation, which in turn supports the manager’s compensation. While basing fees on market value should theoretically align management interests with those of shareholders, it may also create short-term incentives to prioritize immediate results over sustainable dividends.

Let’s look at the most recent sale of I Fashion Outlet Novo Hamburgo. The cap rate of 7.5% was below recent acquisitions at 9%, so it seems profitable on the surface.

As a result of the sale, the fund had R$4.19 available to distribute. The total sale price was 3.6x the initial payment in 2012 and related to a successful construction project. However, the inflation-adjusted price should be approximately 2x. In other words, the assets should be worth twice the initial purchase price, and the real value-added of the successful project was 80%, not 260%. Investors would likely need to reinvest around 38% of the profit distributed from this sale in order to maintain 2012 purchasing power.

Another issue with this model is that it encourages the manager to sell its best assets — the ones that have appreciated the most. The most appreciated assets may be those held the longest, those with the best locations, or both. Selling these assets allows for the greatest profit distribution. In the case of premium assets, it also allows the manager to quote a low cap rate and claim value creation. The manager could be a great negotiator, but more likely, there is a reason why it sold an asset at a 7.5% cap rate and acquired new assets with 9% cap rates. In fact, IFONH had among the lowest vacancy rates in the portfolio, close to 1%, and NOI growth of 10% in 2024.

While HGBS11 management should be given credit for its investment in IFONH, I do not consider this model to be sustainable in the long run.

I prefer funds that retain their performing assets and sustainably increase dividends over time to match or exceed inflation.

HGBS11’s 8.3% sustainable yield compares unfavorably to my estimated peer average of around 9.3% (XPML11, HSML11, MALL11, and VISC11). More concerning is that the fund has a history of declining real dividends, meaning you need to reinvest distributions just to maintain purchasing power.

HGBS11’s dividend does not appear sustainable, at least on a real, inflation-adjusted basis.

Future Outlook & Operational KPIs

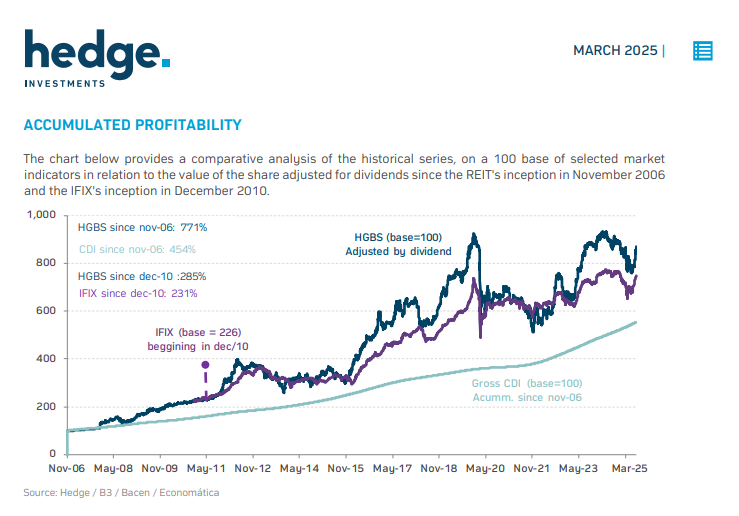

HGBS11 has an impressive track record, dating back to 2006 and outperforming the IFIX index.

Source: HGBS11 March 2025 Management Report

However, much of HGBS11’s outperformance took place earlier on and was more noticeable when there were fewer competing shopping FIIs. While XPML11 has grown its dividend above the rate of inflation since 2019, HGBS11’s dividend has risen nominally by just 11% over the past five years. During the same period of rising interest rates, HGBS11’s unit price fell by 12%, compared to a decline of just 1% for XPML11.

Overall, I think there are better Brazilian brick-and-mortar REIT opportunities, in both the shopping mall and logistics segments that I expect to outperform HGBS11.

While the recent acquisition of assets at reasonable cap rates with strong growth profiles is promising, the fund has also sold assets and returned a portion of what was essentially inflation-adjusted principal to investors. The net long-term benefit to investors is unclear and, as noted above, current headline yields appear unsustainable. Yet its price-to-book value of 0.9x is slightly higher than XPML11 and moderately higher than VISC11, HSML11, and MALL11.

Fund management has forecast a R$0.16 monthly dividend through the end of June 2025, supported by a R$0.074 per-share reserve as of April. They continue to evaluate portfolio recycling opportunities, but the dividend level for the second half of the year remains uncertain.

Same-store sales growth in 2024 was 4.9%, roughly in line with peers at 5.6%. Year-end vacancy of 4.7% was aligned with industry norms, but higher than large shopping FIIs, which averaged 3.6%.

Metrics like NOI and sales per square meter do not suggest that the portfolio should trade at a premium to peers, although the large concentration in São Paulo could provide some justification.

Final Verdict

Despite its long history and reputation, I believe other shopping and logistics brick-and-mortar FIIs offer better opportunities. HGBS11’s dividend has not kept pace with inflation, and there is a meaningful risk that it will not be maintained in the second half of the year.

The current yield does not justify the risk of future dividend reductions, and the portfolio does not warrant a premium valuation relative to its large shopping FII peers.

Disclosure

I currently have no position in HGBS11, although that could change in the future. I do hold positions in other names mentioned in this article, such as XPML11 and HSML11, and may add to or reduce these positions at any time. This content is for informational purposes only and does not constitute financial advice. Always do your own research and consult a licensed advisor before making investment decisions.

IMPORTANT LEGAL DISCLAIMER

The information provided on this website is for general informational purposes only. All content is based on personal opinions, experience, or publicly available data, and is not intended as financial, legal, tax, or investment advice. Nothing here should be construed as a recommendation to buy, sell, or hold any financial instruments.

I am not a certified financial advisor, and I do not know your personal financial situation. Always consult with a qualified professional before making any investment decisions. Gringo Investor and its creator disclaim all liability for any loss or damage incurred as a result of reliance on this information.

Investing involves risks, including the potential loss of principal. Past performance is not indicative of future results.

This site is operated for an international audience and is not intended to comply with CVM regulations or provide formal investment recommendations in Brazil.