O BTLG11 foi lançado em 2010 e é um dos FIIs mais consolidados do Brasil. Atualmente, é o segundo maior FII de logística do país, ficando atrás apenas do HGLG11. Desde 2019, o fundo é gerido pela BTG Pactual, uma grande gestora de investimentos afiliada ao Banco BTG Pactual (BPAC11), um dos maiores bancos de investimento e gestores de patrimônio da América Latina.

O BTLG11 é um dos maiores e mais líquidos REITs do Brasil, com valor de mercado de R$4,3 bilhões. Ele representa 3,12% do índice IFIX e é a quarta maior participação no ETF HERT11, com um peso de 6,51%.

Observação: esta página foi atualizada pela última vez em 23 de junho de 2025.

Fatos Principais do BTLG11

| Métrica | Valor |

| Nome do Fundo | BTG Pactual Logistica FII |

| Gestor | BTG Pactual |

| Taxa de administração | 0,90% do valor de mercado |

| Site da gestora | https://btlg.btgpactual.com/ |

| Início | 03/08/2010 |

| Setor | FIIs Logísticos |

| Valor | R$4.3B |

| Número de imóveis | 34 ativos logísticos |

| Área Bruta Locável (ABL) | ~1.300.000 metros quadrados |

| Preço atual | R$99.69 |

| Preço sobre Valor Patrimonial (P/VP) | 0.96 |

| Dividend Yield (12 meses) | 9.41% |

| Inclusão em Índices/ETFs | IFIX, HERT11 |

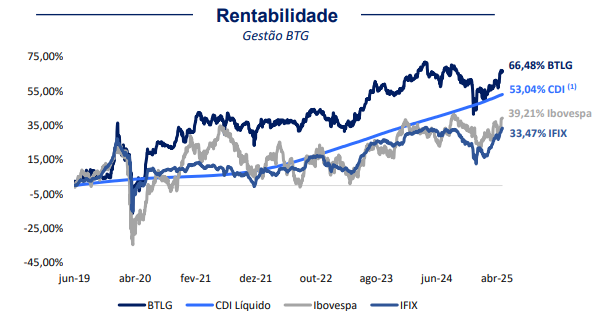

De acordo com o Relatório Gerencial de maio de 2025, o BTLG11 superou a taxa básica de juros do Brasil (CDI), o índice IFIX e o benchmark IBOVESPA desde junho de 2019.

Histórico de Desempenho

Fonte: Relatório Gerencial de maio de 2025

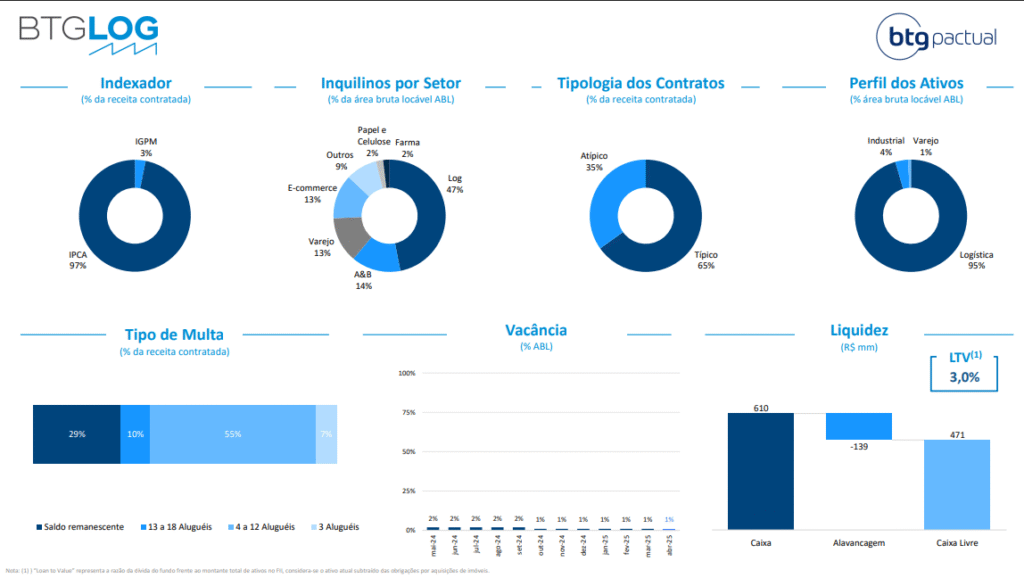

Visão Geral do Portfólio

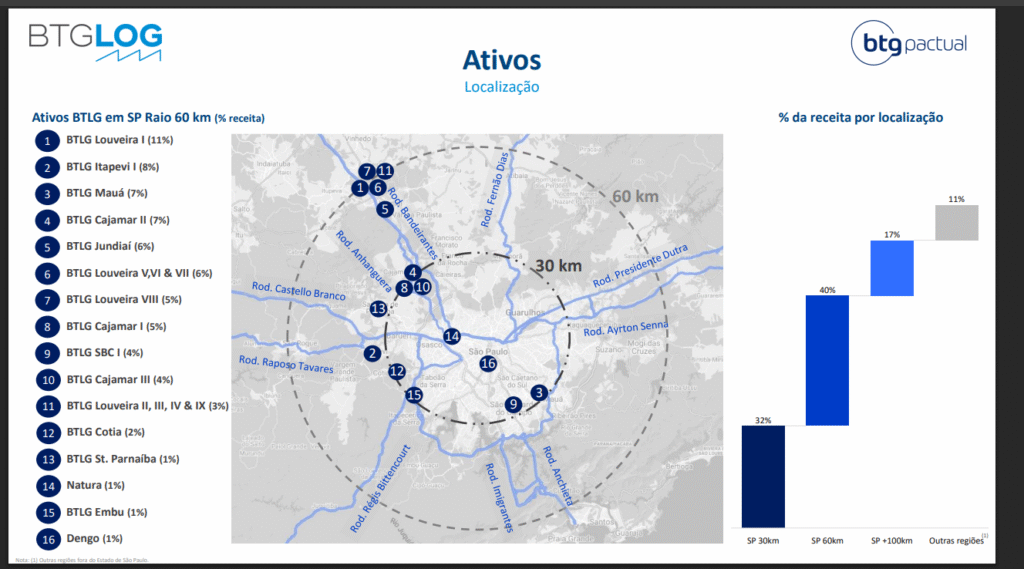

O BTG Pactual Logística FII possui um portfólio diversificado de 34 imóveis logísticos, totalizando aproximadamente 1,3 milhão de metros quadrados de Área Bruta Locável (ABL). O fundo tem como foco hubs logísticos de alta densidade, com 90% da ABL localizada no estado de São Paulo e 72% a até 60 km da capital. Sua estratégia de aquisição concentra-se em ativos de padrão A+.

A tabela abaixo mostra os imóveis do BTLG11 localizados próximos a São Paulo.

Fonte: Apresentação Gerencial

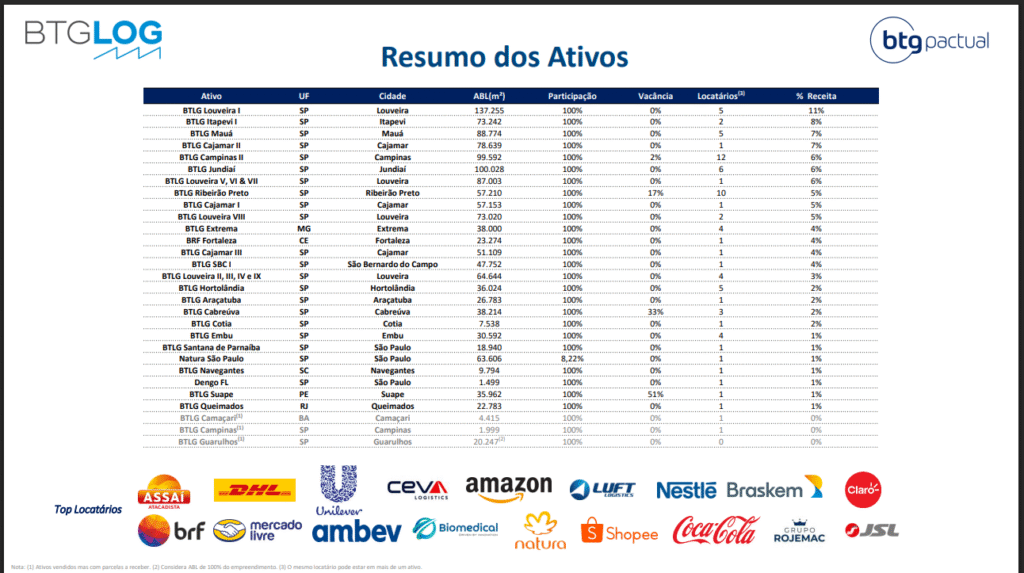

A tabela abaixo lista os maiores ativos do BTLG11 por Área Bruta Locável (ABL), incluindo o nome de cada imóvel, localização, percentual de participação e a participação na receita total de aluguel do fundo. Também apresenta as taxas de vacância e o número de locatários por ativo. Em quase todos os casos, o BTLG11 detém a propriedade integral dos imóveis.

Fonte: Apresentação Gerencial

Comparação Setorial e Indicadores-Chave (KPIs)

O BTLG11 é atualmente o segundo maior FII de logística no IFIX, ficando atrás apenas do HGLG11 em tamanho.

Com um dividend yield de 12 meses de 9,41%, o BTLG11 fica 47 pontos-base abaixo da mediana dos FIIs de logística, que é de 9,88%. No entanto, devido ao seu porte e histórico, é mais adequado compará-lo a pares de primeira linha do setor logístico, como o HGLG11, XPLG11e o BRCO11.

Seu índice preço sobre valor patrimonial (P/VP) de 0,96x está bem acima da mediana dos pares logísticos do IFIX (0,80x) e é amplamente consistente com outros fundos de primeira linha: HGLG11 (0,98x), XPLG11 (0,92x) e BRCO11 (0,92x).

O BTLG11 manteve distribuições de dividendos estáveis nos últimos cinco anos. No entanto, seu crescimento de dividendos foi modesto, com uma taxa composta de crescimento anual (CAGR) de apenas 2,4% entre 2022 e 2024, ficando abaixo da inflação.

👉 Deslize para o lado no celular para visualizar o gráfico completo