O HGLG11 foi lançado em 2010 e é um dos fundos imobiliários mais consolidados do Brasil. Atualmente, é o maior FII de logística do país, à frente de BTLG11. O fundo foi originalmente gerido pelo Credit Suisse, mas em maio de 2024 foi adquirido pela Patria Investimentos, a maior gestora independente de ativos da América Latina, com mais de R$23 bilhões em ativos imobiliários e R$263 bilhões em ativos totais sob gestão.

O HGLG11 é um dos maiores e mais líquidos REITs do Brasil, com uma capitalização de mercado de R$5,3 bilhões. Ele representa 3,86% do índice IFIX e é a segunda maior participação no ETF HERT11, com um peso de 8,69%.

Observação: esta página foi atualizada pela última vez em 24 de junho de 2025.

Fatos Principais do HGLG11

| Métrica | Valor |

| Nome do Fundo | Patria Log FII RL |

| Gestor | Patria Investimentos |

| Taxa de administração | 0,60% do valor de mercado |

| Site da gestora | https://realestate.patria.com/tijolo/hglg11/ |

| Início | 06/05/2010 |

| Setor | FIIs Logísticos |

| Valor | R$5.3B |

| Número de imóveis | 28 ativos logísticos |

| Área Bruta Locável (ABL) | ~1.600.000 metros quadrados |

| Preço atual | R$157.45 |

| Preço sobre Valor Patrimonial (P/VP) | 0.97 |

| Dividend Yield (12 meses) | 8.41% |

| Inclusão em Índices/ETFs | IFIX, HERT11 |

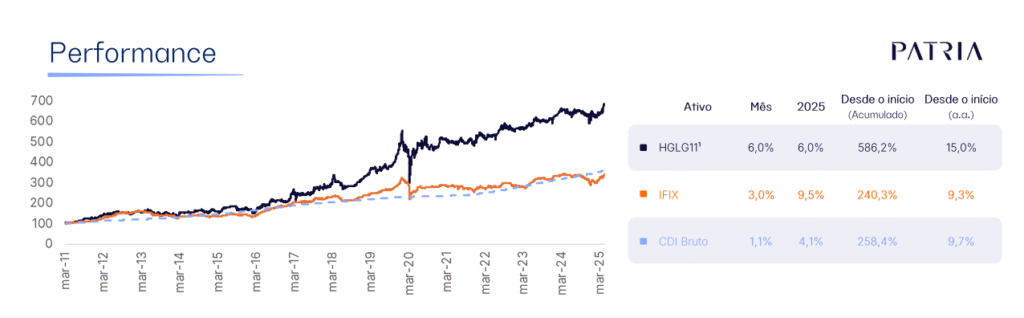

De acordo com o Relatório Gerencial de abril de 2025, o HGLG11 superou tanto o índice IFIX quanto a taxa básica de juros brasileira (CDI) no longo prazo. Entre março de 2011 e março de 2025, o fundo apresentou um retorno total de 586,2%, equivalente a um retorno anualizado de 15,0%.

Histórico de Desempenho

Fonte: Relatório Gerencial de abril de 2025

Visão Geral do Portfólio

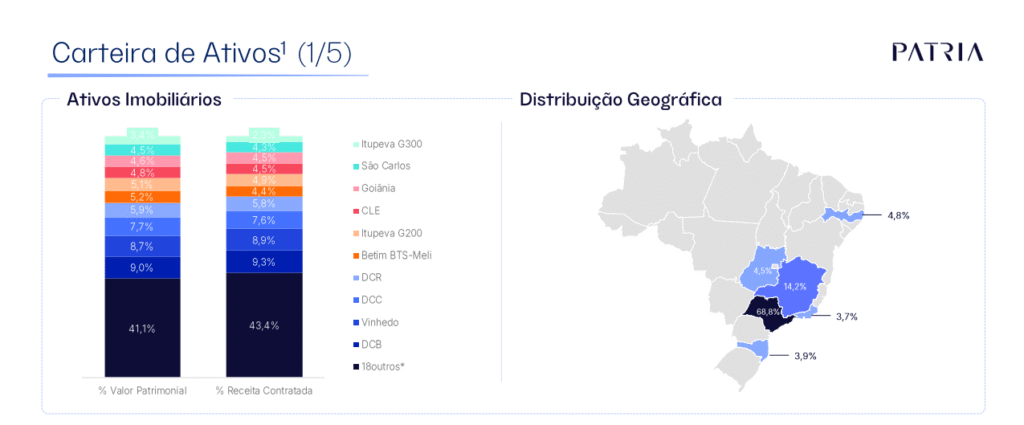

O portfólio do HGLG11 inclui 28 imóveis logísticos, totalizando aproximadamente 1,6 milhão de metros quadrados de Área Bruta Locável (ABL). A receita de aluguel está distribuída por seis estados brasileiros, com a maior parte proveniente de São Paulo (68,8%) e Minas Gerais (14,2%).

O gráfico abaixo mostra a exposição geográfica do HGLG11, junto com a distribuição dos valores dos imóveis e do aluguel contratado por ativo. O maior imóvel individual representa 9,0% do valor patrimonial do fundo e 9,3% da sua receita de aluguel.

Fonte: Apresentação Gerencial

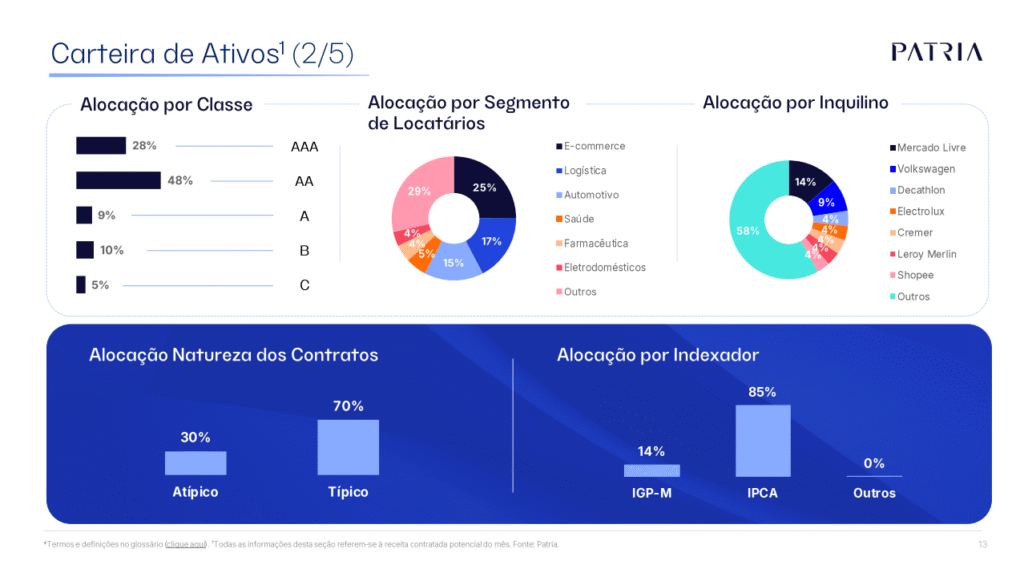

85% dos contratos de locação do HGLG11 estão indexados ao IPCA, e 14% ao IGP-M, o que significa que quase todos os contratos estão atrelados à inflação. A maioria dos acordos (70%) segue estruturas típicas de locação, enquanto o restante é atípico.

O portfólio é composto principalmente por ativos de alta qualidade, sendo 28% classificados como ‘AAA’, 48% como ‘AA’ e 9% como ‘A’. Os locatários abrangem diversos setores, com destaque para o comércio eletrônico (25%). O Mercado Livre é o maior locatário individual, representando 14% da receita de aluguel.

Fonte: Apresentação Gerencial

Comparação Setorial e Indicadores-Chave (KPIs)

📈 Valor de Mercado e Yield

O HGLG11 é o maior FII de logística do IFIX, com valor de mercado mais de R$1 bilhão superior ao do BTLG11. Apresenta um dividend yield de 12 meses de 8,41%, ficando 147 pontos-base abaixo da mediana dos FIIs logísticos, que é de 9,88%. Contudo, devido ao seu porte e longevidade, é mais adequado compará-lo a pares de primeira linha como o BTLG11, XPLG11e o BRCO11.

🧮 Avaliação

O HGLG11 é negociado com um índice preço/valor patrimonial (P/VP) de 0,97x, acima da mediana dos pares logísticos do IFIX, que é de 0,80x, e em linha com BTLG11 (0,96x), XPLG11 (0,92x) e BRCO11 (0,92x).

💸 Padrão de Dividendos

Historicamente, o HGLG11 fez pagamentos especiais periódicos além do dividendo básico, utilizando o excedente acumulado que, por lei, deve ser distribuído em até 6 meses. Esses pagamentos tornaram-se menores e menos frequentes, e o dividendo básico de R$1,10 por mês permanece inalterado desde julho de 2021.

Em abril de 2025, o fundo possuía uma reserva acumulada de R$0,56 por cota.

👉 Deslize para o lado no celular para visualizar o gráfico completo

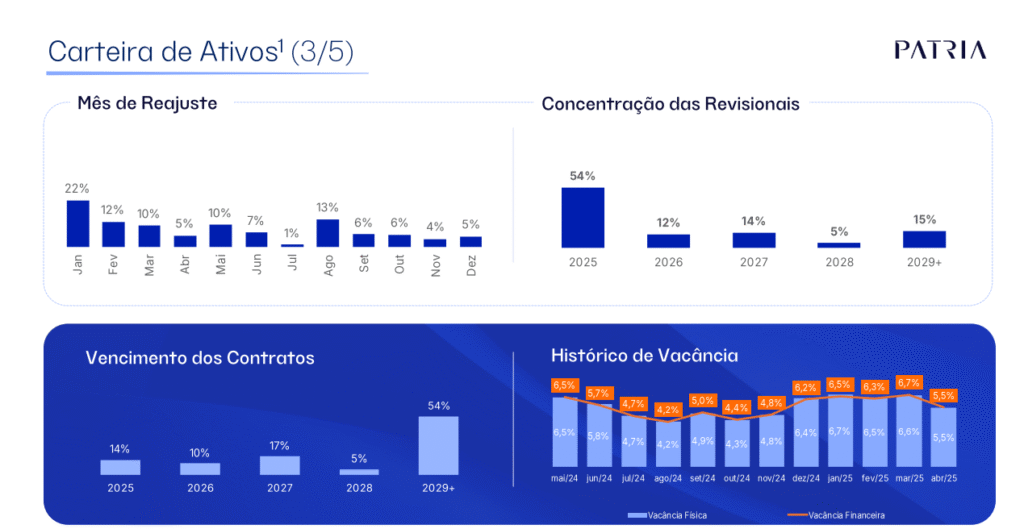

📉 Vacância e Perfil dos Contratos de Locação

Em abril de 2025:

- Taxa de vacância: 5,5% (contra 1% do BTLG11)

- WAULT (Prazo Médio Ponderado dos Contratos): 4,6 anos (contra 5,2 anos do BTLG11)

- Vencimento dos contratos: 54% dos contratos vencem em 2029 ou depois

Fonte: Patria Log FII RL - Relatório Gerencial de abril

📘 Saiba Mais

- Se você é novo no mercado de FIIs (REITs brasileiros), confira meu Guia para Investidores Internacionais ou Como Eu Escolho FIIs

- Para gráficos e tabelas excelentes, confira a página do HGLG11 em O Funds Explorer.

🔗 Páginas Relacionadas

Aviso de Conflito de Interesses

Até o momento, não possuo posição no HGLG11, embora isso possa mudar no futuro. Este conteúdo é apenas para fins informativos e não constitui aconselhamento financeiro. Sempre faça sua própria pesquisa e consulte um profissional licenciado antes de tomar decisões de investimento.

IMPORTANTE: AVISO LEGAL

As informações fornecidas neste site são apenas para fins informativos gerais. Todo o conteúdo se baseia em opiniões pessoais, experiências ou dados publicamente disponíveis e não deve ser interpretado como aconselhamento financeiro, jurídico, tributário ou de investimentos. Nada aqui deve ser entendido como uma recomendação para comprar, vender ou manter qualquer instrumento financeiro.

Não sou consultor financeiro certificado e não conheço sua situação financeira pessoal. Sempre consulte um profissional qualificado antes de tomar qualquer decisão de investimento. O Gringo Investor e seu criador isentam-se de qualquer responsabilidade por perdas ou danos decorrentes do uso dessas informações.

Investir envolve riscos, incluindo a possibilidade de perda total do capital. Resultados passados não garantem retornos futuros.

Este site é voltado para um público internacional e não se destina a cumprir regulamentações da CVM ou fornecer recomendações formais de investimento no Brasil.

Este artigo foi originalmente escrito em inglês. Para ler na versão original, mude o idioma do site para Inglês usando o seletor de idiomas no menu.