Lançado em 2018, o XPLG11 é o terceiro maior fundo de investimento imobiliário (FII) de logística do Brasil, ficando logo atrás do HGLG11 e BTLG11. Gerido pela XP Asset Management, o fundo possui um valor de mercado de aproximadamente R$3,1 bilhões. Ele representa 2,21% do índice IFIX e possui um peso de 5,07% no ETF HERT11.

Observação: esta página foi atualizada pela última vez em 24 de junho de 2025.

XPLG11 Key Facts

| Métrica | Valor |

| Nome do Fundo | XP Log FII |

| Gestor | XP Asset Management |

| Taxa de administração | 0,75% sobre o patrimônio administrado + 20% de taxa de performance (acima do IPCA + 6%) |

| Site da gestora | https://www.xpasset.com.br/fundos/xp-log/ |

| Início | 01/06/2018 |

| Setor | FIIs Logísticos |

| Valor | R$3.1B |

| Número de imóveis | 17 ativos logísticos |

| Área Bruta Locável (ABL) | ~1.000.000 metros quadrados |

| Preço atual | R$97.96 |

| Preço sobre Valor Patrimonial (P/VP) | 0.90 |

| Dividend Yield (12 meses) | 9.84% |

| Inclusão em Índices/ETFs | IFIX, HERT11 |

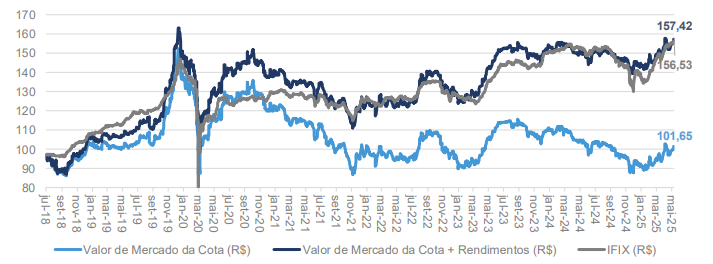

De julho de 2018 a maio de 2025, o XPLG11 apresentou um retorno total de aproximadamente 57%, acompanhando de perto o desempenho do IFIX.

Histórico de Desempenho

Fonte: Relatório Gerencial de maio de 2025

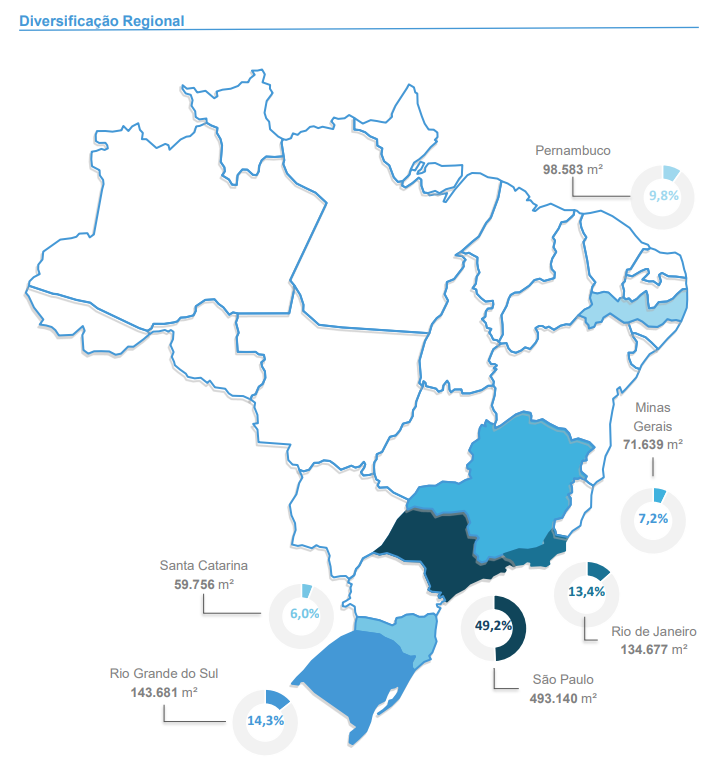

Visão Geral do Portfólio

O portfólio do XPLG11 inclui 17 imóveis, totalizando aproximadamente 1,0 milhão de metros quadrados de Área Bruta Locável (ABL), posicionando-o como um dos principais FIIs de logística do Brasil. A receita de aluguel está distribuída por seis estados brasileiros, com a maior participação da ABL vindo de São Paulo (49,2%), seguida pelo Rio Grande do Sul (14,3%) e Rio de Janeiro (13,4%). 9,8% da ABL provém de Pernambuco, no Nordeste.

Fonte: Apresentação Gerencial de maio

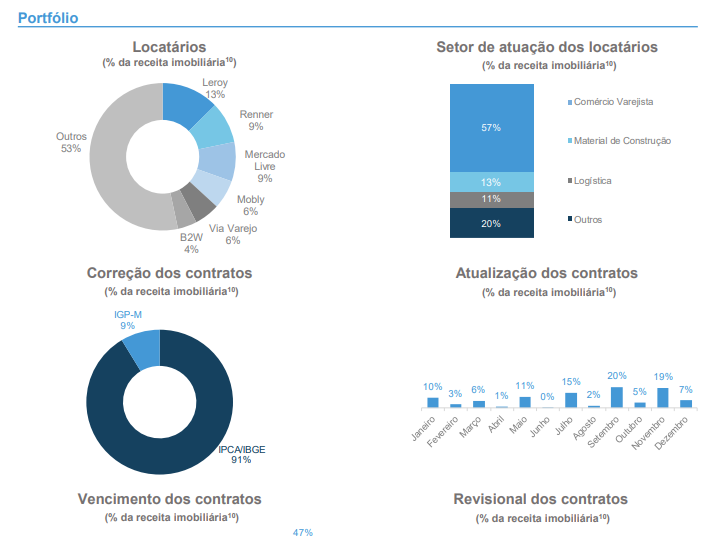

O gráfico abaixo mostra a distribuição setorial, os principais locatários e a indexação dos contratos do XPLG11.

Fonte: Relatório Gerencial de maio

91% dos contratos de locação do XPLG11 estão indexados ao IPCA, e 9% ao IGP-M, o que significa que todos os contratos estão atrelados à inflação, característica comum dos FIIs de logística brasileiros. A maior exposição a um locatário individual é com a Leroy (13%) e 57% do portfólio está exposto ao comércio varejista.

Os contratos de locação estão divididos de forma equilibrada entre “típicos” e “atípicos”. Embora os contratos atípicos ofereçam maior segurança contratual, eles podem também refletir imóveis mais especializados, o que pode aumentar o risco de vacância em caso de insolvência do locatário.

Comparado a um fundo como o BTLG11, eles tendem a ter mais locatários em um único imóvel. Por um lado, isso cria maior diversificação, mas por outro pode ser mais arriscado e difícil de administrar do que ter um único locatário grande, como a Amazon.

Comparação Setorial e Indicadores-Chave (KPIs)

📈 Valor de Mercado e Yield

O XPLG11 é o terceiro maior FII de logística do IFIX, com valor de mercado de R$3,1 bilhões. Apresenta um dividend yield de 12 meses de 9,84%, aproximadamente em linha com a mediana dos FIIs de logística, que é de 9,88%. Devido ao seu porte e histórico, é mais adequado compará-lo a pares de primeira linha como HGLG11, BTLG11 e BRCO11.

🧮 Avaliação

O XPLG11 é negociado com um índice preço sobre valor patrimonial (P/VP) de 0,90x, acima da mediana dos pares logísticos do IFIX (0,80x), mas abaixo do HGLG11 (0,97x), BTLG11 (0,96x) e BRCO11 (0,92x).

💸 Padrão de Dividendos

Historicamente, o XPLG11 tem distribuído dividendos mensais consistentes e, nos últimos anos, esses dividendos cresceram em ritmo igual ou superior à inflação. Por exemplo, o crescimento dos dividendos atingiu uma taxa composta de crescimento anual (CAGR) de 5,4% entre 2022 e 2024.

👉 Deslize para o lado no celular para visualizar o gráfico completo

📉 Vacância e Perfil dos Contratos de Locação

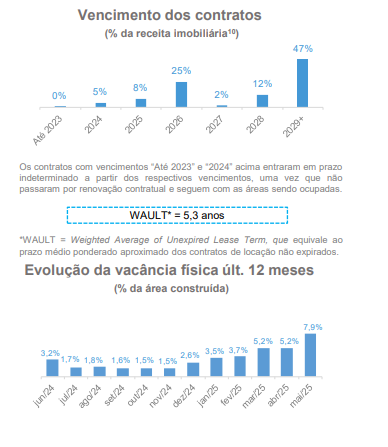

O XPLG11 possui um prazo médio ponderado dos contratos de locação (WALT) de 5,3 anos, semelhante ao do BTLG11 (5,2 anos) e superior ao do HGLG11 (4,6 anos). Quase 47% dos contratos vencem em 2029 ou depois, o que sustenta expectativas de renda estável no médio prazo.

No entanto, apesar dessa estrutura sólida de contratos, a vacância aumentou para 7,9% em maio de 2025. Esse valor é significativamente maior que o dos fundos pares BTLG11 (1%) e HGLG11 (5,5%) e pode pressionar a receita de aluguel no curto prazo caso os ativos logísticos vagos não sejam rapidamente realocados.

Fonte: XP Log FII – Relatório Gerencial de Maio de 2025

📘 Saiba Mais

- Se você é novo no mercado de FIIs (REITs brasileiros), confira meu Guia para Investidores Internacionais ou Como Eu Escolho FIIs

- Para gráficos e tabelas excelentes, confira a página do XPLG11 em O Funds Explorer.

🔗 Páginas Relacionadas

Aviso de Conflito de Interesses

Até o momento, não possuo posição no XPLG11, embora isso possa mudar no futuro. Este conteúdo é apenas para fins informativos e não constitui aconselhamento financeiro. Sempre faça sua própria pesquisa e consulte um profissional licenciado antes de tomar decisões de investimento.

IMPORTANTE: AVISO LEGAL

As informações fornecidas neste site são apenas para fins informativos gerais. Todo o conteúdo se baseia em opiniões pessoais, experiências ou dados publicamente disponíveis e não deve ser interpretado como aconselhamento financeiro, jurídico, tributário ou de investimentos. Nada aqui deve ser entendido como uma recomendação para comprar, vender ou manter qualquer instrumento financeiro.

Não sou consultor financeiro certificado e não conheço sua situação financeira pessoal. Sempre consulte um profissional qualificado antes de tomar qualquer decisão de investimento. O Gringo Investor e seu criador isentam-se de qualquer responsabilidade por perdas ou danos decorrentes do uso dessas informações.

Investir envolve riscos, incluindo a possibilidade de perda total do capital. Resultados passados não garantem retornos futuros.

Este site é voltado para um público internacional e não se destina a cumprir regulamentações da CVM ou fornecer recomendações formais de investimento no Brasil.

Este artigo foi originalmente escrito em inglês. Para ler na versão original, mude o idioma do site para Inglês usando o seletor de idiomas no menu.