Lançado em 2018, o HGRU11 é o maior fundo de investimento imobiliário (FII) urbano do Brasil, à frente do TRXF11 e do RBVA11 em valor de mercado. O fundo era originalmente gerido pelo Credit Suisse, mas em maio de 2024 foi adquirido pela Patria Investimentos, a maior gestora independente de ativos da América Latina, com mais de R$23 bilhões em ativos imobiliários e R$263 bilhões em ativos totais sob gestão.

O fundo representa 2,09% do índice IFIX e possui um peso de 4,84% no ETF HERT11.

Vale lembrar que esta página foi atualizada pela última vez em 26 de junho de 2025.

Principais informações sobre o HGRU11

| Métrica | Valor |

| Nome do Fundo | Patria Renda Urbana FII |

| Gestor | Patria Investimentos |

| Taxa de administração | 0,70% do patrimônio líquido ao ano + taxa de performance de 20% sobre o que exceder IPCA + 5,5% ao ano |

| Site da gestora | https://realestate.patria.com/tijolo/hgru11/ |

| Início | Abril de 2018 |

| Setor | Urbanos |

| Valor | R$2.9B |

| Número de imóveis | 104 imóveis urbanos |

| Área Bruta Locável (ABL) | ~613.000 metros quadrados |

| Preço atual | R$125.74 |

| Preço sobre Valor Patrimonial (P/VP) | 0.99 |

| Dividend Yield (12 meses) | 9.61% |

| Inclusão em Índices/ETFs | IFIX, HERT11 |

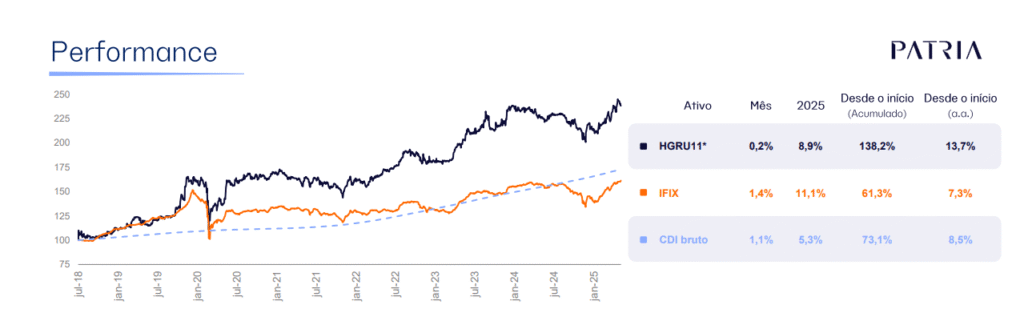

Desde seu lançamento em 2018, o HGRU11 entregou um retorno total de 138,2%, ou 13,7% ao ano, bem acima do índice de referência IFIX (7,3%) e da taxa do CDI (8,5%) no mesmo período.

Histórico de Desempenho

Fonte: Relatório Gerencial de maio de 2025

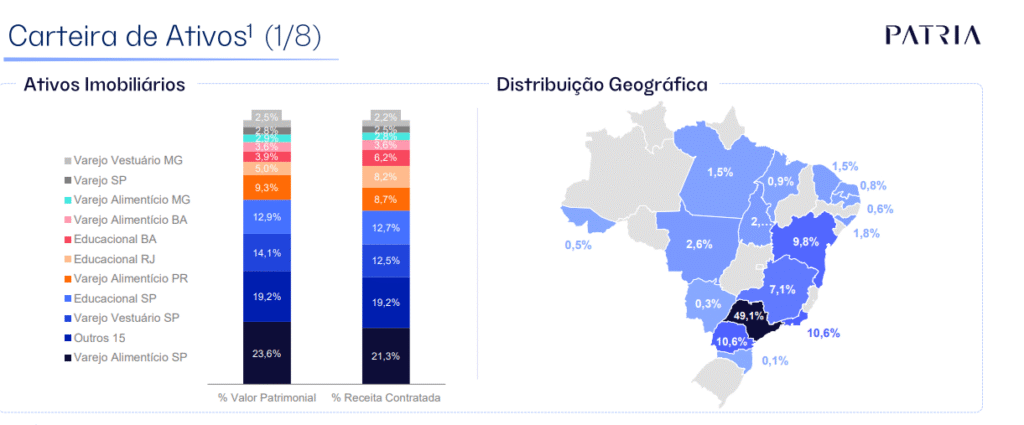

Visão Geral do Portfólio

O portfólio do HGRU11 é composto por 104 imóveis urbanos, totalizando aproximadamente 613.000 metros quadrados de Área Bruta Locável (ABL), o que o torna o maior FII com foco urbano do Brasil. A receita de aluguel é geograficamente diversificada entre dezesseis estados brasileiros, com São Paulo representando quase metade da ABL total (49,1%), seguido por Paraná e Rio de Janeiro, com 10,6% cada.

O portfólio é majoritariamente locado para redes de supermercados, instituições de ensino e varejistas de vestuário, oferecendo uma combinação de serviços essenciais e consumo discricionário.

Fonte: Apresentação Gerencial de maio

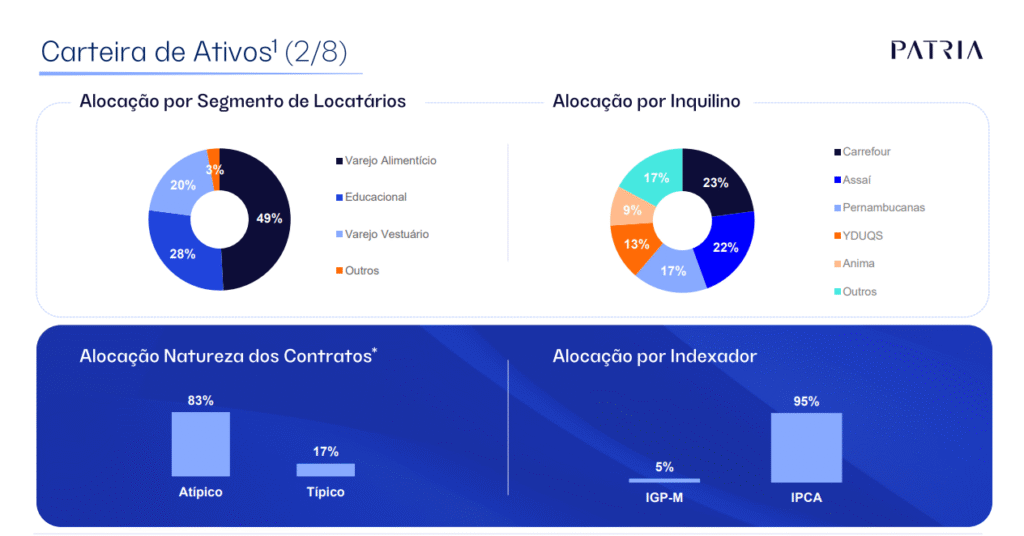

Os gráficos abaixo mostram a composição do portfólio do HGRU11 por segmento de locatários, principais inquilinos, estrutura contratual e indexação à inflação.

Fonte: Relatório Gerencial de maio

Todos os contratos de locação do HGRU11 são indexados à inflação: 95% ao IPCA e 5% ao IGP-M. A maior exposição do portfólio é a inquilinos do setor supermercadista (49%), seguida por instituições de ensino (28%) e varejo de vestuário (20%).

83% dos contratos são estruturados como atípicos (contratos irrevogáveis, geralmente com prazos mais longos), enquanto 17% são típicos (contratos comerciais padrão com cláusulas de rescisão convencionais). Embora os contratos atípicos ofereçam maior segurança contratual, eles frequentemente envolvem imóveis mais especializados, o que pode aumentar o risco de vacância em caso de inadimplência do locatário.

Vale destacar que redes de supermercados com margens baixas e varejistas de bens discricionários podem representar riscos de longo prazo. O HGRU11 tem alta exposição ao Carrefour (23%), Assaí (22%) e Pernambucanas (17%). Também possui uma exposição de 9% à Ânima Educação (ANIM3), uma empresa de ensino privado alavancada.

Comparação Setorial e Indicadores-Chave (KPIs)

📈 Valor de Mercado e Yield

O HGRU11 é o maior FII urbano, com valor de mercado de R$2,9 bilhões. Oferece um dividend yield de 9,61% nos últimos 12 meses, abaixo da mediana dos FIIs urbanos, que é de 12,99%. No entanto, há apenas outros quatro FIIs urbanos no IFIX, o que pode limitar a relevância da comparação. O dividend yield de 12 meses está mais alinhado com o de grandes FIIs do setor logístico.

🧮 Avaliação

O HGRU11 é negociado com uma relação preço/valor patrimonial (P/VPA) de 0,99x, acima da mediana dos FIIs urbanos do IFIX, que é de 0,89x. Essa valorização também está mais alinhada com a dos grandes FIIs logísticos.

💸 Padrão de Dividendos

O HGRU11 historicamente tem distribuído dividendos mensais consistentes, que nos últimos anos, em geral, acompanharam o crescimento da inflação.

Em maio de 2025, o fundo gerou R$0,87 de receita mensal recorrente por cota e distribuiu R$0,90 por cota, com apoio de R$1,14 em lucros acumulados não distribuídos. Os dividendos mensais recorrentes tendem a crescer ao longo do tempo, enquanto distribuições maiores, realizadas a cada seis meses, oferecem um potencial adicional, embora sejam menos previsíveis.

👉 Deslize para o lado no celular para visualizar o gráfico completo

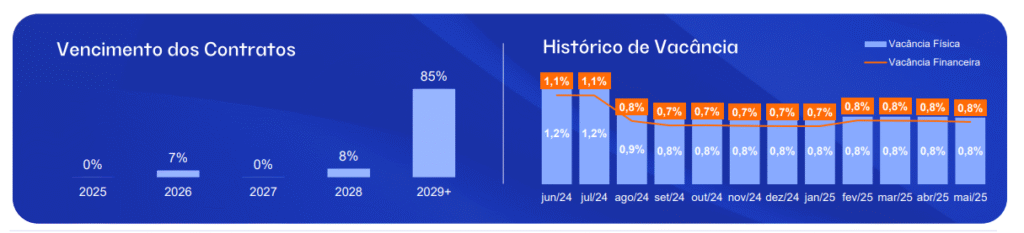

📉 Vacância e Perfil dos Contratos de Locação

O HGRU11 possui um prazo médio ponderado dos contratos (WALT) de 9,5 anos, com 85% dos contratos vencendo a partir de 2029, o que sustenta expectativas de renda estável no médio prazo.

A vacância se manteve baixa, com média inferior a 1% nos últimos 12 meses. Ainda assim, o perfil de locatários pode apresentar riscos no longo prazo.

Fonte: Pátria Renda Urbana FII – Relatório Gerencial de Maio

🩸Endividamento

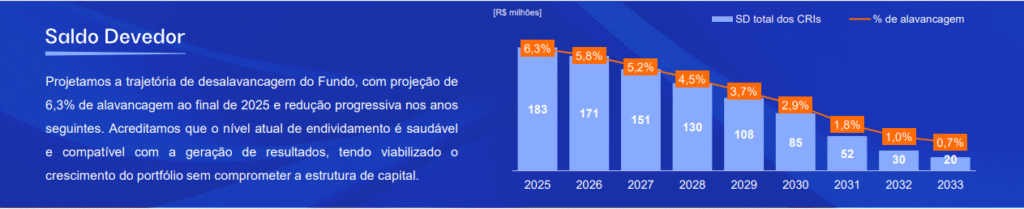

O HGRU11 mantém um perfil de endividamento modesto, com alavancagem projetada em 6,3% até o final de 2025 e redução programada nos anos seguintes. O nível atual é considerado saudável e tem viabilizado o crescimento do portfólio sem comprometer a estrutura de capital do fundo.

Fonte: Pátria Renda Urbana FII – Relatório Gerencial de Maio

📘 Saiba Mais

- Se você é novo no mercado de FIIs (REITs brasileiros), confira meu Guia para Investidores Internacionais ou Como Eu Escolho FIIs

- Para gráficos e diagramas interessantes, confira a página do HGRU11 em O Funds Explorer.

🔗 Páginas Relacionadas

Aviso de Conflito de Interesses

No momento da redação deste conteúdo, não possuo posição em HGRU11, embora isso possa mudar no futuro. Este conteúdo tem caráter meramente informativo e não constitui recomendação de investimento. Sempre faça sua própria análise e consulte um assessor financeiro habilitado antes de tomar decisões de investimento.

IMPORTANTE: AVISO LEGAL

As informações fornecidas neste site são apenas para fins informativos gerais. Todo o conteúdo se baseia em opiniões pessoais, experiências ou dados publicamente disponíveis e não deve ser interpretado como aconselhamento financeiro, jurídico, tributário ou de investimentos. Nada aqui deve ser entendido como uma recomendação para comprar, vender ou manter qualquer instrumento financeiro.

Não sou consultor financeiro certificado e não conheço sua situação financeira pessoal. Sempre consulte um profissional qualificado antes de tomar qualquer decisão de investimento. O Gringo Investor e seu criador isentam-se de qualquer responsabilidade por perdas ou danos decorrentes do uso dessas informações.

Investir envolve riscos, incluindo a possibilidade de perda total do capital. Resultados passados não garantem retornos futuros.

Este site é voltado para um público internacional e não se destina a cumprir regulamentações da CVM ou fornecer recomendações formais de investimento no Brasil.

Este artigo foi originalmente escrito em inglês. Para ler na versão original, mude o idioma do site para Inglês usando o seletor de idiomas no menu.