Launched in 2020 by VBI Real Estate and now managed by Patria Investimentos, PVBI11 holds a portfolio of seven premium office towers in São Paulo. In today’s oversupplied market, it’s worth examining each property more closely.

The fund has a market capitalization of approximately R$2.1 billion, representing 1.49% of the IFIX index and 3.46% in the HERT11 ETF.

Last updated: June 29, 2025.

PVBI11 Key Facts

| Metric | Value |

| Fund Name | VBI Prime Properties |

| Gestor | Patria Investimentos |

| Management Fee | 1.0% of Market Capitalization |

| Manager Website | https://realestate.patria.com/tijolo/pvbi11/ |

| Inception | July, 2020 |

| Setor | Escritórios |

| Valor | R$2.1B |

| Number of Properties | 7 Office Towers |

| Gross Leaseable Area (ABL) | ~83K sqm. |

| Current Price | R$75.26 |

| Price-to-Book Value | 0.72 |

| Dividend Yield (Trailing 12M) | 8.87% |

| Auditor (Last Annual Report) | PWC |

| Appraiser | Binswanger Brazil |

| Index/ETF Inclusion | IFIX, HERT11 |

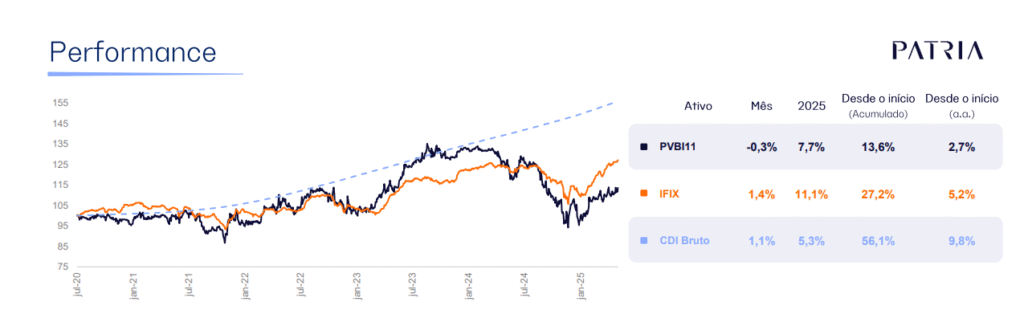

Performance Track Record

The chart below, sourced from Patria, shows PVBI11’s total return with dividends reinvested since inception in July 2020. The fund has delivered an annualized return of 2.7%, underperforming both the IFIX benchmark (5.2%) and the CDI rate (9.8%).

Source: May 2025 Management Report

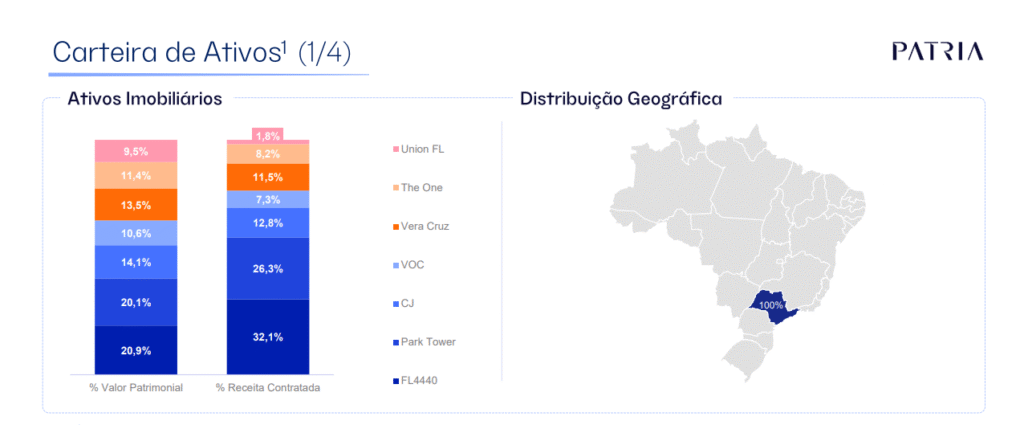

Portfolio Overview

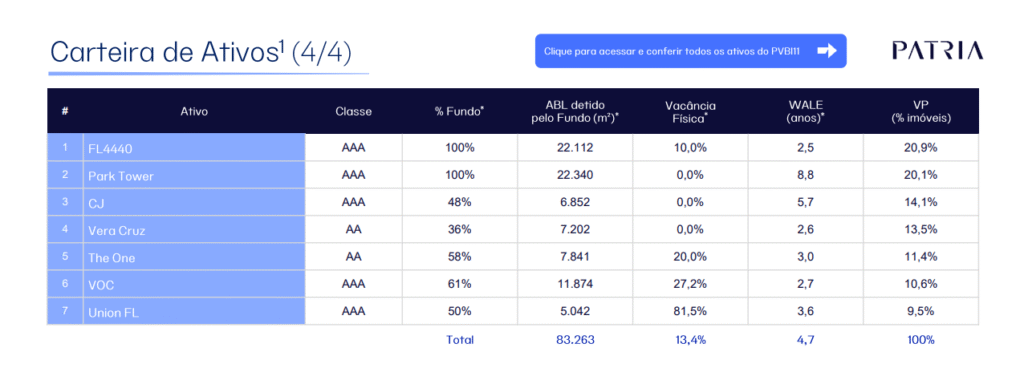

PVBI11’s portfolio includes seven office towers totaling approximately 83,000 square meters of Gross Leasable Area (GLA). In some cases, the fund holds less than full ownership. All properties are located in São Paulo and are listed below in order of their share of the fund’s total book value.

- Faria Lima 4440 (20.9%): 22,111 sqm., Class ‘AAA’

- Park Tower (20.1%): 22,340 sqm., Class ‘AAA’

- Cidade Jardim (14.1%): 6,852 sqm., Class ‘AA’

- Vera Cruz II (13.5%): 7,202 sqm., Class ‘AA’

- The One (11.4%): 7,842 sqm., Class ‘AA’

- Vila Olimpia Corporate (10.6%): 12,630 sqm., Class ‘AAA’

- Union Faria Lima (9.5%): 5,024 sqm., Class ‘A’

Note on Building Classifications:

In some cases, the building classifications reported in the latest management report are higher than those shown on Patria’s individual property webpages, which tend to use more conservative ratings. For consistency, the classifications referenced here follow the website unless otherwise supported. Third-party sources generally aligned with the website’s rating, with one exception: Vila Olímpia Corporate, listed as ‘AA’ on the site, was identified as ‘AAA’ by external sources. These discrepancies may stem from different evaluation criteria or reporting timelines, but taken together they offer a helpful view of the portfolio’s quality and positioning.

The chart below shows the fund’s rental income and book value by building.

Source: May Management Presentation

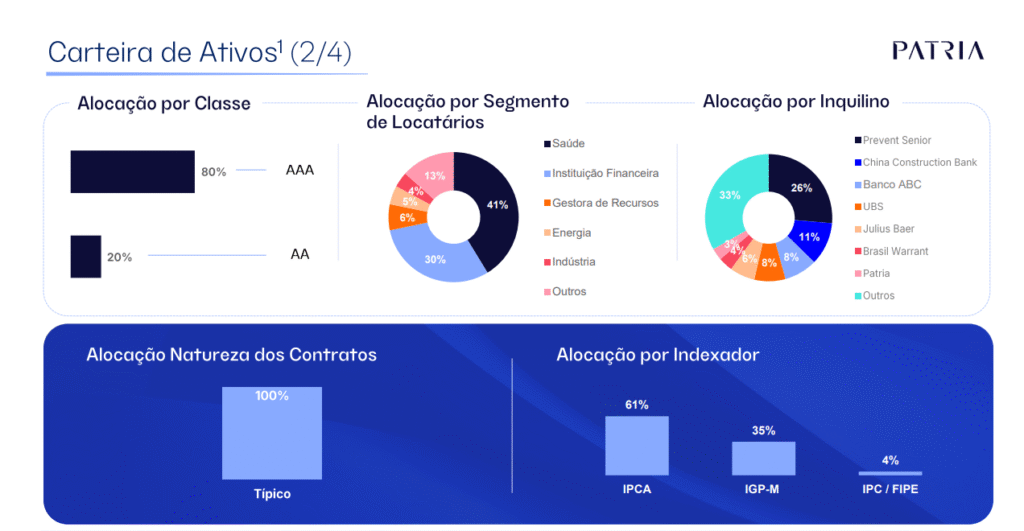

The fund’s portfolio is heavily concentrated in healthcare (41%), with 26% of total rent coming from a single tenant, Prevent Senior, a healthcare provider focused on the 60+ age segment. Financial services make up the next largest sector, including a 3% lease exposure to Patria itself.

Tenant quality is generally high: 80% are classified as ‘AAA’ and 20% as ‘AA’. Many are well-known names in Brazil, which supports income stability. Still, Prevent Senior’s size creates tenant concentration risk. However, the company is headquartered in Park Tower, a ‘AAA’-rated building, which helps reduce relocation risk in the near term.

Separately, China Construction Bank (CCB) is vacating the flagship FL 4440 building, increasing the fund’s overall vacancy above 20%. Although FL 4440 is among São Paulo’s 10 most expensive properties, and considered a ‘trophy’ asset, re-leasing such a large space could take time despite the high rental potential.

All leases are classified as ‘typical’ and are indexed to inflation: IPCA (61%), IGP-M (35%), and IPC/FIPE (4%).

Source: May Management Presentation

Sector Comparison & KPIs

📈 Market Cap & Yield

PVBI11 is the largest pureplay office FII, with a market capitalization of R$2.1 billion. It currently offers a 12-month dividend yield of 8.87%, below the office FII median of 12.09%. However, as the largest fund in the sector, it’s essential to evaluate its specific building mix, asset classes, and tenant concentrations before drawing conclusions.

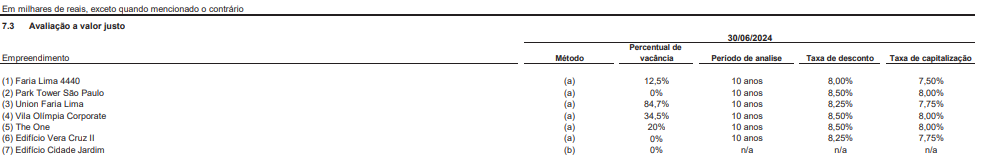

🧮 Valuation

PVBI11 trades at a price-to-book ratio of 0.73x, in line with the median for office FIIs in the IFIX. While its portfolio is concentrated in São Paulo properties rated ‘AA’ or ‘AAA’, vacancy remains a key concern. As of May, 2025, three buildings representing 31.5% of the portfolio’s book value had vacancy rates between 20% and 81.5%. Union Faria Lima, completed in 2023 and currently 81.5% vacant, has shown only marginal improvement since June 2024, when vacancy stood at 84.7%.

Despite this, Patria’s 2024 valuation (based on appraisals from Binswanger Brazil) applied conservative cap rates between 7.50% and 8.00%, suggesting the fund’s properties are still viewed as high-quality. Notably, there was little difference in cap rates between the flagship FL 4440 (7.50%) and the largely vacant Union Faria Lima (7.75%).

As of May 2025, the fund’s portfolio was valued at just over R$19,000 per square meter, which is significantly below typical pricing for ‘AAA’ assets in prime locations like Faria Lima. A proper asset-by-asset analysis would be required to confirm value, but the current valuation could present some upside.

🧠 Outlook and Sector Context

Valuation ultimately hinges on one question: will the São Paulo office market recover?

If so, PVBI11 could lease vacant space and raise rental rates, particularly in ‘AAA’ properties. If not, rising vacancies and softer rents could lead to further NAV erosion.

Long-term structural trends remain uncertain. Hybrid work continues to reduce demand for ‘A’ assets, and advances in AI may shrink white-collar headcount, such as junior legal or finance roles.

On the other hand, in April, São Paulo recorded its lowest office vacancy rate since the pandemic and rental prices rose 15% in 2024. While citywide vacancy remains elevated at 18.3%, premium submarkets like Nova Faria Lima have rebounded, with vacancy rates as low as 6%.

💸 Dividend Pattern

PVBI11 has struggled to maintain dividends in a challenging post-COVID office market, with payouts now below 2021 levels. The current monthly dividend of R$0.50, which may be difficult to sustain, implies a yield of 7.9%. This suggests the market is pricing in expectations of long-term recovery.

Management notes a potential to increase income by R$0.12/unit by filling existing vacancies. The fund has also been able to increase rent significantly in its trophy FL 4440 property, in 2024 seeing the opportunity to increase rent 20% to $R250/sqm., nearly double what it was in 2020 ($R135/sqm.).

However, vacancy could rise from 13.4% to 22.4% by September, if two large tenants are not replaced. One of them, China Construction Bank (CCB), has given notice it will vacate FL 4440, which could reduce monthly income by R$0.06 starting in June if not backfilled.

In May, the fund paid a distribution of R$0.50, which represented 100% of income. It also held R$0.16 in undistributed reserves, likely excluding R$0.16 to be received from CCB as part of its lease termination. This suggests PVBI11 may be able to sustain the R$0.50 dividend for several months, though visibility is limited after that.

Looking further ahead, many lease renewals and rent reviews are scheduled for 2027. This could support stronger cash flows, but also poses risk in an oversupplied office market. In addition, new zoning rules passed by São Paulo city hall in 2024 may allow taller buildings in Faria Lima, increasing future supply and competition with existing ‘AAA’ inventory.

👉 Scroll sideways on mobile to view the full chart

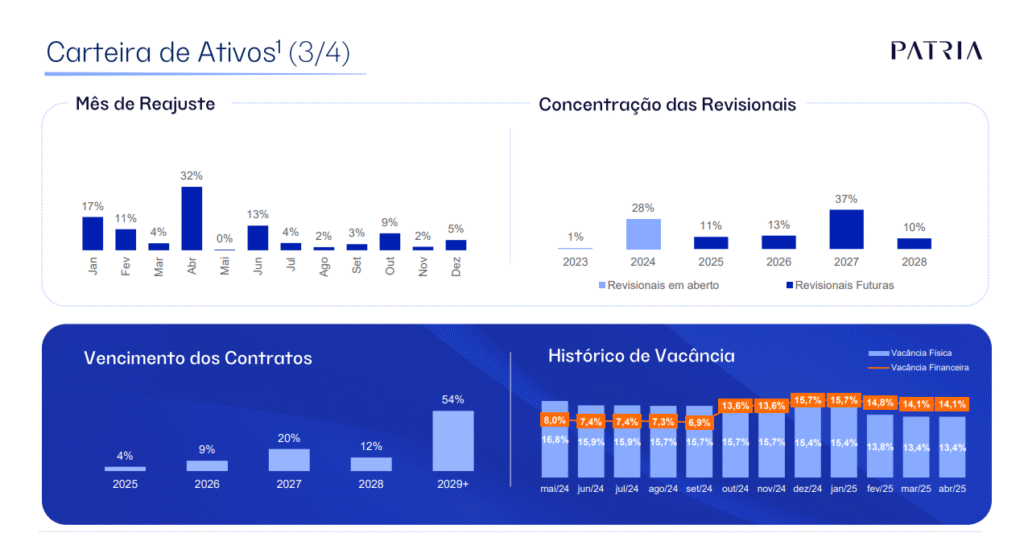

📉 Vacancy & Lease Profile

Despite predominantly holding ‘AA’ and ‘AAA’ office properties in São Paulo, PVBI11’s fiscal vacancy rose from 8.0% in May 2024 to 14.1% in May 2025.

Source: May Management Report

In its May Management Report, Patria noted that two tenants are expected to vacate by September. If the space is not re-leased, fiscal vacancy could increase from 13.4% to 22.4%. Management did not provide guidance on financial vacancy, which could rise even further, particularly since one of the tenants is based in the flagship FL 4440 building.

Looking ahead, the fund does not expect income growth in 2025, but is more optimistic for 2026. However, 20% of leases expire in 2027, and 37% are subject to rent reviews that same year. This creates additional medium-term uncertainty if the rental market does not improve.

Vacancy is highly concentrated in a few buildings. While PVBI11’s three largest assets by book value have low vacancy, the three smallest, which together represent over 30% of the portfolio, have vacancy rates ranging from 20% to 81.5%. This concentration likely contributes to the fund’s discount, with units currently trading at 0.72x book value.

The 81.5% vacancy in the newly delivered Union FL building is particularly notable. Despite its location near Faria Lima and at least Class ‘A’ credentials, the building has struggled to attract tenants. In 2024, Itau reportedly paid nearly R$60,000 per square meter to acquire its AAA Faria Lima office, highlighting a bifurcation between trophy assets and the rest. In a soft market, tenants can afford to be selective.

The fund’s weighted average lease term is 4.7 years, but materially shorter for all buildings except Park Tower and Vera Cruz.

Source: May Management Report

As noted earlier, some of the building classifications shown here are higher than those listed on individual property pages within Patria’s website.

📘 Learn More

- If you’re new to Brazilian REITs (FIIs), check out my Guide for Global Investors or How I Choose FIIs

- For some great charts and graphs check out PVBI11’s page on O Funds Explorer.

🔗 Related Pages

Aviso de Conflito de Interesses

As of this writing, I do not hold a position in PVBI11, though that may change in the future. This content is for informational purposes only and does not constitute financial advice. Always do your own research and consult a licensed advisor before making investment decisions.

IMPORTANTE: AVISO LEGAL

As informações fornecidas neste site são apenas para fins informativos gerais. Todo o conteúdo se baseia em opiniões pessoais, experiências ou dados publicamente disponíveis e não deve ser interpretado como aconselhamento financeiro, jurídico, tributário ou de investimentos. Nada aqui deve ser entendido como uma recomendação para comprar, vender ou manter qualquer instrumento financeiro.

Não sou consultor financeiro certificado e não conheço sua situação financeira pessoal. Sempre consulte um profissional qualificado antes de tomar qualquer decisão de investimento. O Gringo Investor e seu criador isentam-se de qualquer responsabilidade por perdas ou danos decorrentes do uso dessas informações.

Investir envolve riscos, incluindo a possibilidade de perda total do capital. Resultados passados não garantem retornos futuros.

Este site é voltado para um público internacional e não se destina a cumprir regulamentações da CVM ou fornecer recomendações formais de investimento no Brasil.

Este artigo foi originalmente escrito em inglês. Para ler na versão original, mude o idioma do site para Inglês usando o seletor de idiomas no menu.