Launched in 2006, HGBS11 was one of Brazil’s first multi-asset shopping mall FIIs and helped establish the segment as a cornerstone of the country’s real estate market. It also holds international significance as Brazil’s first member of the US-based National Association of Real Estate Investment Trusts (Nareit), and is currently the only Brazilian REIT rated by S&P.

HGBS11 is one of the largest and most liquid retail-focused REITs in Brazil, with a market capitalization of R$2.5 billion and a 1.82% weighting in the IFIX index. With a 4.16% weighting, it is also a major component of the HERT11 ETF, an ETF managed by Hedge Investments, which also sponsors HGBS11.

Its scale, liquidity, and international outreach make it a key reference point for foreign investors exploring Brazilian REITs.

Note that this page was last updated June 23, 2025.

HGBS11 Key Facts

| Metric | Value |

| Fund Name | Hedge Brasil Shopping FII |

| Gestor | Hedge Investments |

| Management Fee | 0.60% of market value |

| Manager Website | https://www.hedgeinvest.com.br/fundos/hgbs/ |

| Inception | 28/12/2006 |

| Setor | Shoppings |

| Valor | R$2.5B |

| Number of Properties | 20 Malls |

| Gross Leaseable Area (ABL) | ~245,000 square meters |

| Current Price | R$19.48 |

| Price-to-Book Value | 0.90 |

| Dividend Yield (Trailing 12M) | 9.97% |

| Index/ETF Inclusion | IFIX, HERT11 |

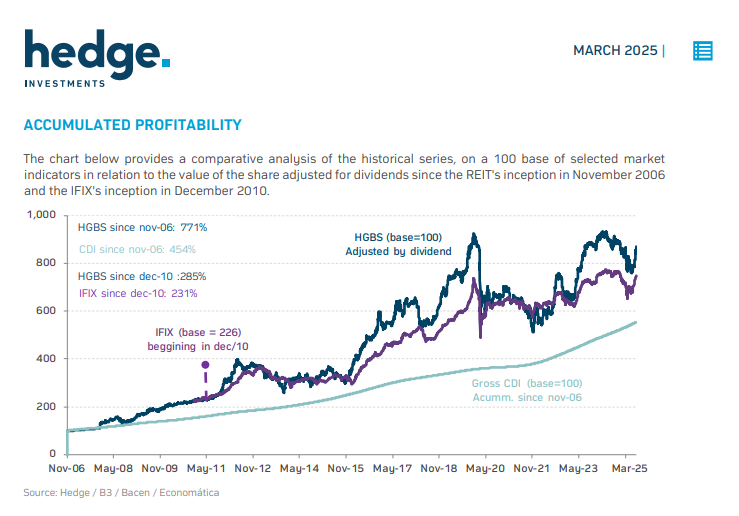

As a pioneer in the field, HGBS11 has a long and impressive track-record.

Performance Track Record

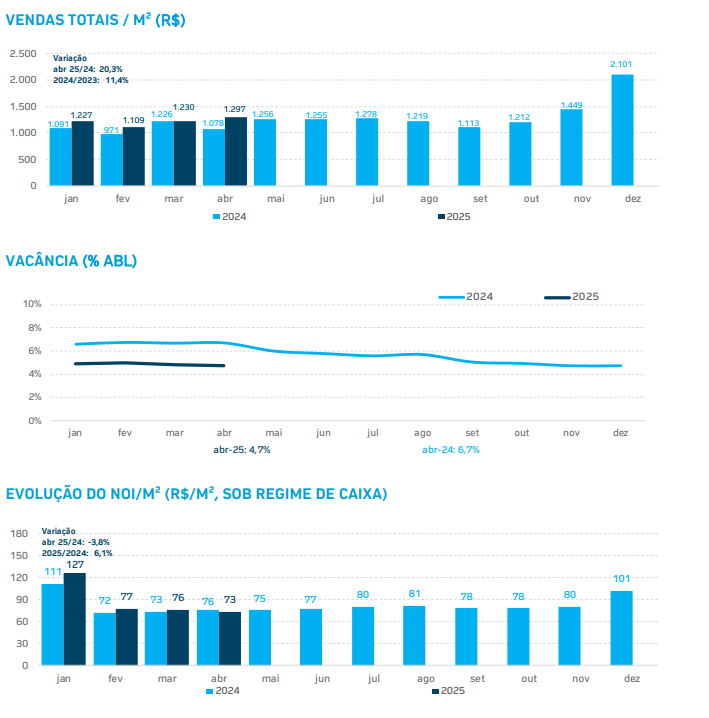

Fonte: Relatório Gerencial HGBS11 – Março de 2025

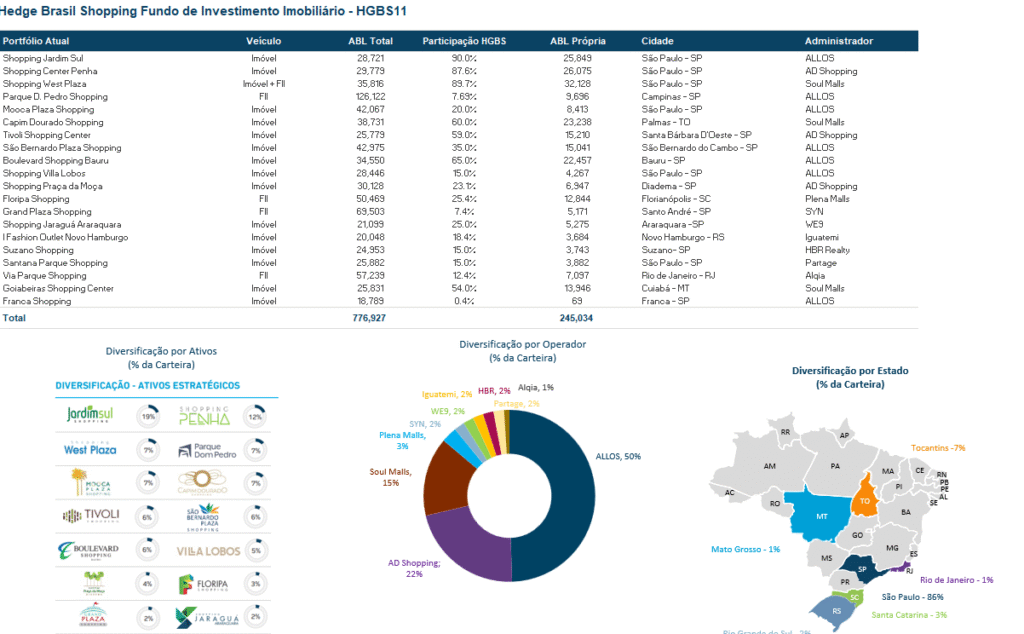

Portfolio Overview

O Hedge Brasil Shopping FII possui um portfólio diversificado com 20 shoppings, totalizando aproximadamente 245.000 metros quadrados de Área Bruta Locável (ABL). O fundo tem como foco a aquisição de participações em shoppings com pelo menos 15.000 metros quadrados de ABL, administrados por operadores experientes e especializados. Em muitos casos, o HGBS11 detém participações minoritárias, em vez de controle total.

The table below lists HGBS11’s top holdings by ABL, showing the name of the mall, city, total ownership percentage, and each property’s share of the portfolio’s total ABL. The table also provides a breakdown of the fund’s ABL by Administrator.

Note: Imóvel indicates a direct real estate asset, while FII refers to indirect ownership via another REIT structure.

Fonte: Planilha do HGBS11 disponível no seu site..

With 86% of HGBS11’s portfolio allocated to the state of São Paulo, the fund is concentrated in Brazil’s most premium retail market. Operationally, half of the portfolio is managed by ALLOS.

Sector Comparison & KPIs

HGBS11 is the third largest of 10 shopping mall FIIs listed on the IFIX.

The fund’s 12-month dividend yield of 9.97% is 92 bps below the shopping FII median (10.89%). But given its size and history, it’s better benchmarked against peers like XPML11 and VISC11.

Its price-to-book value of 0.90x is above the median of its IFIX peers (0.80x), but aligned with XPML11 (0.89x) and more than VISC11 (0.83x).

Aside from the COVID period, the fund has delivered consistent dividends since 2019, despite several follow-on offerings. However, dividends grew at a CAGR of 2.8% between 2019 and 2024, below inflation. The yield is currently boosted by non-recurring gains from asset sales.

👉 Scroll sideways on mobile to view the full chart