Launched in 2014, VISC11 is Brazil’s second largest shopping mall real estate investment fund (FII), ranking behind only XPML11. Managed by Vinci Partners, one of Latin America’s leading alternative asset managers overseeing US$53B, the fund has a market capitalization of approximately R$3.0 billion. It represents 2.14% of the IFIX index and carries a weight of 4.97% in the HERT11 ETF.

Note that this page was last updated June 25, 2025.

VISC11 Key Facts

| Metric | Value |

| Fund Name | Vinci Shopping Centers FII |

| Gestor | Vinci Partners |

| Management Fee | 1.05% of market value (>R$2B) |

| Manager Website | https://www.vincifundoslistados.com/nossos-fundos/vinci-shopping-centers-fii-visc11/ |

| Inception | 10/03/2014 |

| Setor | Shoppings |

| Valor | R$3.0B |

| Number of Properties | 30 Malls |

| Gross Leaseable Area (ABL) | ~288,000 square meters |

| Current Price | R$102.81 |

| Price-to-Book Value | 0.84 |

| Dividend Yield (Trailing 12M) | 9.28% |

| Index/ETF Inclusion | IFIX, HERT11 |

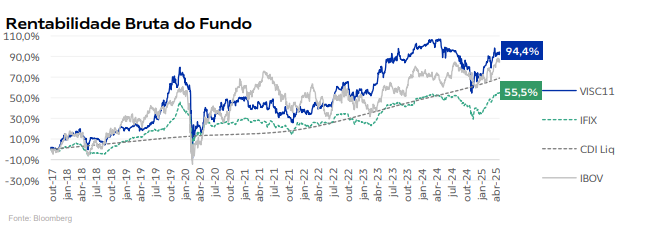

Between October 2017 and April 2025, VISC11 generated a total gross return of 94.4%, outperforming the IFIX index (55.5%) and delivering results in line with Brazil’s CDI benchmark.

Performance Track Record

Source: May 2025 Management Report

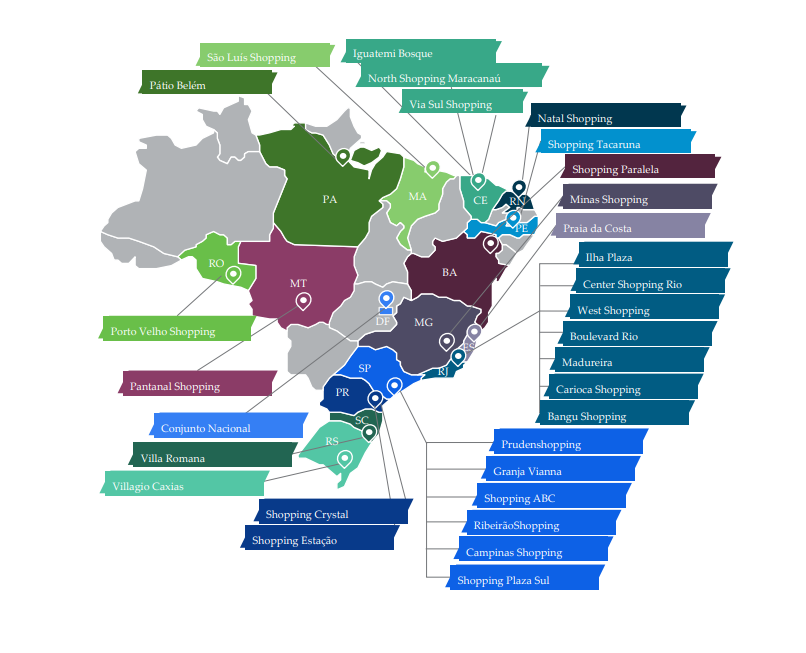

Portfolio Overview

VISC11’s portfolio includes interests in 30 shopping centers, with total proportional ownership of approximately 288,000 square meters of Gross Leasable Area (GLA). This makes it one of Brazil’s most geographically diversified shopping mall FIIs. Rental income is distributed across 15 Brazilian states, with the largest share of net operating income (NOI) concentrated in São Paulo (32%). Compared to peers like XPML11 (~50% of ABL) and HGBS11 (86%), VISC11 is significantly less concentrated in the São Paulo region.

Note: XPML11 and HGBS11 figures refer to ABL, not NOI.

Source: May Management Presentation

VISC11’s portfolio is managed across 11 different shopping mall operators, with Ancar and Argo responsible for 31% and 21% of NOI, respectively. The fund frequently holds minority stakes in its properties, with controlling positions accounting for just 32% of total NOI.

The chart below shows that NOI is distributed well across its 30 shopping interests, with the most significant share only accounting for 12% and the rest for less than 10%.

Source: May Management Report

Sector Comparison & KPIs

📈 Market Cap & Yield

VISC11 is the second largest shopping FII on the IFIX, with a market capitalization of R$3.0B. It offers a 12-month dividend yield of 9.28%, below the shopping FII median of 10.89%. Due to its scale and track record, it is best compared to top-tier peers like XPML11, HGBS11, HSML11, and MALL11.

🧮 Valuation

VISC11 trades at a price-to-book ratio of 0.84x, above the IFIX shopping peer median of 0.80x, but below XPML11 (0.89x) and HGBS11 (0.91x), and above HSML11 (0.78x) and MALL11 (0.83x).

💸 Dividend Pattern

Except during the COVID-19 period, VISC11 has delivered consistent monthly dividends, with long-term growth roughly tracking inflation.

👉 Scroll sideways on mobile to view the full chart

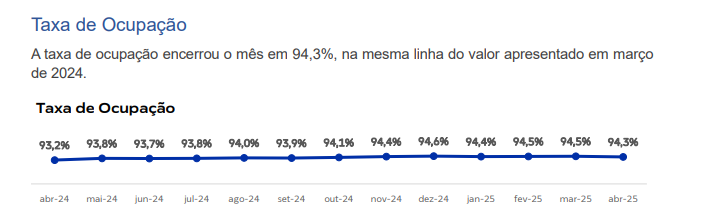

📉 Vacancy & Other KPIs

Between 2023 and 2024, same-store sales (SSS) grew 5.5%, roughly in line with VISC11’s major peers (HGBS11, XPML11, MALL11, HSML11). April 2025 showed stronger performance at 11.1%, though this was likely influenced by the timing of Easter.

Vacancy has remained relatively steady, but at 5.7% it remains well above the peer group average, which hovers closer to 4%.

Source: Vinci Shopping Centers FII – May Management Report

📘 Learn More

- If you’re new to Brazilian REITs (FIIs), check out my Guide for Global Investors or How I Choose FIIs

- For some great charts and graphs check out VISC11’s page on O Funds Explorer.

🔗 Related Pages

Aviso de Conflito de Interesses

As of this writing, I do not hold a position in VISC11, though that may change in the future. This content is for informational purposes only and does not constitute financial advice. Always do your own research and consult a licensed advisor before making investment decisions.

IMPORTANTE: AVISO LEGAL

As informações fornecidas neste site são apenas para fins informativos gerais. Todo o conteúdo se baseia em opiniões pessoais, experiências ou dados publicamente disponíveis e não deve ser interpretado como aconselhamento financeiro, jurídico, tributário ou de investimentos. Nada aqui deve ser entendido como uma recomendação para comprar, vender ou manter qualquer instrumento financeiro.

Não sou consultor financeiro certificado e não conheço sua situação financeira pessoal. Sempre consulte um profissional qualificado antes de tomar qualquer decisão de investimento. O Gringo Investor e seu criador isentam-se de qualquer responsabilidade por perdas ou danos decorrentes do uso dessas informações.

Investir envolve riscos, incluindo a possibilidade de perda total do capital. Resultados passados não garantem retornos futuros.

Este site é voltado para um público internacional e não se destina a cumprir regulamentações da CVM ou fornecer recomendações formais de investimento no Brasil.

Este artigo foi originalmente escrito em inglês. Para ler na versão original, mude o idioma do site para Inglês usando o seletor de idiomas no menu.